In the world of logistics IT, what a difference two years haven’t made! This year’s respondents to O+F’s benchmark survey of information technology voice much the same concerns and preoccupations that surfaced when we conducted this study two years ago.

Although multichannel operations have established themselves as a standard way of doing business, there appears to be a lot of scrambling going on behind the scenes as systems managers scurry around upgrading legacy applications, connecting disparate programs, and generally patching things together to give customers the illusion that the operation is seamless. Only 34.4% of our respondents cite hardware and software platform integration as their most significant IT accomplishment in the past 12 months; a mere 19.1% have implemented interactive technologies for customers. Use of Web-based IT architecture, implemented by 22.1% of our respondents, is still low, although it has increased from the 15.9% reported in our 2002 survey.

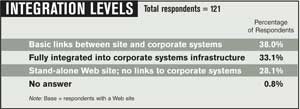

Systems integration levels remain almost unchanged since 2002. Among respondents with Web sites, 28.1% of the sites are stand-alones, with no links to corporate systems; 38% have basic links; and 33.1% — just a tad more than the 29% reported in 2002 — are fully integrated with other systems in the organization.

HAUTE COUTURE

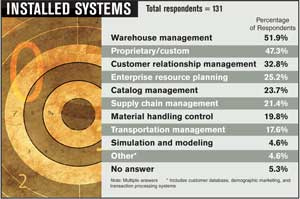

It also appears that fewer IT managers are getting what they want from off-the-shelf systems. The number of respondents using proprietary or customized technology has jumped to 47.3% from 36.1% two years ago. Although warehouse management systems remain the most popular application, with 51.9% of our respondents employing them, other programs have increased in usage since 2002. These include systems for enterprise resource planning (25.2% vs. 17.8%), material handling control (19.8% vs. 15.9%), and transportation management (17.6% vs. 14.4%).

The percentage of respondents using catalog management systems has dropped markedly, from 38% in 2002 to 23.7% this year, and installation of customer relationship management applications has barely inched upward, from 32.7% in 2002 to 32.8% in 2004. The provision of real-time inventory information — crucial to successful online commerce — has dropped from 68.8% of our respondents in 2002 to 61.1% this year.

On the flip side, there’s some hope for wireless technology (including RFID) and XML. Two years ago, 28.4% of our respondents had installed wireless, and 15.4% used XML; today, those numbers have gone up to 38.9% for wireless and 21.4% for XML. A surprisingly strong 15.3% of respondents have migrated to the Linux operating system, and usage of Windows NT has dropped from 67.8% of respondents in 2002 to 54.2% this year. Respondents also appear to be making greater use of information technology to handle sophisticated functions; this year, 25.2% say their systems guide product placement based on current or projected picking volumes, compared to just 11.5% two years ago.

STAYING HOME

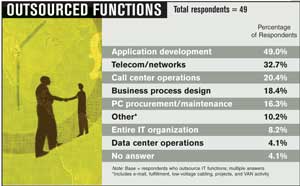

The most volatile issue in IT today is offshore outsourcing, but companies in the direct-commerce business seem to resist the trend more forcefully than firms in other sectors. Only 37.4% of our respondents outsource IT activities, and of that segment, a mere 8.2% send work overseas. This group, though, mirrors the practices of most U.S. companies in that the bulk of its offshore IT work — 75% — goes to India.

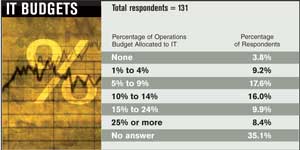

As always, there simply isn’t much money to go around. A survey by Forrester Research Inc. reports that IT investment in the U.S. is slowing down, and will grow just a modest 6% annually between 2003 and 2008 as users focus on generating returns from the technology they have already bought (see p. 8). Our findings support this conclusion. Nearly half of our respondents (46.6%) say the portion of their operations budget allocated to IT is less than 15%. Of that amount, 65.3% is used to maintain or enhance existing applications, leaving limited resources for purchasing or developing new programs.

Rama Ramaswami is editorial director of O+F.

IBM’s Kean: ‘Focus on Integration’

After the dot-coms tanked some years ago, people expected online sales to go south as well, says Katie Kean, vice president of IBM WebSphere Commerce. “But quite the opposite has happened.” Internet commerce is thriving — alongside traditional retailing techniques. Kean suggests ways to make the two work together:

-

Connect all channels. Making a multichannel business work smoothly is still problematic for retailers, even established merchants who are used to working with complex systems. “What we recommend is that they look at the systems they have and focus on integration,” says Kean.

-

Take a holistic approach. “Multichannel can’t be achieved through point solutions,” says Kean. “Multichannel, to a retailer, is all about providing transparency. It touches areas of your business that you never had any idea it would touch. The key thing is to make sure you’re dealing with open systems.”

-

Invest in unified technology. IBM’s WebSphere Commerce products provide a scalable infrastructure on a single platform — something that more and more companies are looking for as they look to upgrade or replace their e-commerce software, Kean says. “We’re seeing this with customers like Staples — they’re choosing a single commerce infrastructure and building around it.”

-

Be creative. Kean notes that integrated applications are not limited to large businesses; small and mid-sized companies can also use them imaginatively. She cites the case of a Chevrolet dealership that used WebSphere Commerce Express to build its entire online store from scratch in five weeks.

-

Realign the organization. Kean stresses that the primary ingredient for success in multichannel selling is to establish a customer-centric view of the business from the top down. Systems integration is not just about software but about transforming a business through technology, she adds. “At the end of the day, that’s the business imperative.”

— RR

Methodology

On June 4, 2004, Primedia Business Marketing Research mailed cover letters and two-page questionnaires (each containing 23 questions) to 1,000 domestic O+F subscribers selected by operations management and IT management job functions on an nth name basis. A $1 incentive was included in the mailing. By July 30, 131 usable surveys were received, for a response rate of 13.1%. Means and medians were calculated according to standard statistical practices. Results were reported in three categories: companies with annual sales under $10 million (32.1%), between $10 million and $49.9 million (28.2%), and $50 million or more (37.4%). Nearly half of the respondents (47.3%) hold positions in operations management. In the “Other” category, 9.9% of respondents cite jobs in apps programming, consulting, product management, or corporate business analysis. Primedia Business research manager Thomas Grant conducted the research for this report. To purchase a copy of the study, visit www.opsandfulfillment.com.

— RR