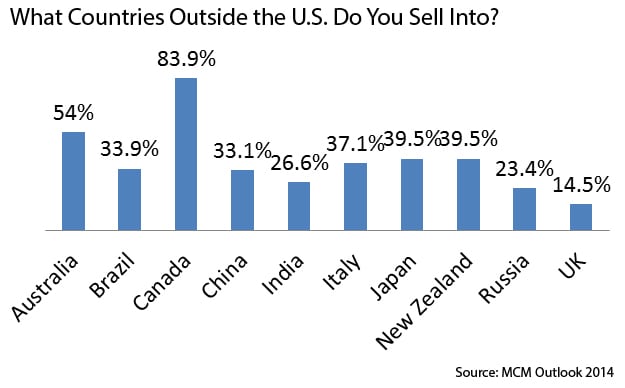

Canada (84%) and Australia (54%) are the top choices for cross-border ecommerce, followed by Japan and New Zealand (39% each), according to the results of Multichannel Merchant’s MCM Outlook 2014.

Many American retailers and ecommerce experts refer to Canada as “the 51st state” because of its proximity and openness to U.S.-produced goods.

According to research from global card processing firm Payvision, 60% of Canada’s online shoppers buy from U.S.-based merchants, and 37% of the world’s cross-border power shoppers are Canadian. Also, eMarketer reports that 7 out of every 10 online purchases made in Canada are from merchants outside the country.

“The reason Canadians are shopping online in such large numbers is either because they can’t get it from domestic retailers, or because they can get a better price,” said Misko Kancko, director of international strategy for Canada Post, at Multichannel Merchant’s Growing Global conference. “There’s a large flow of inbound goods.”

Kancko said the primary reason for shopping cart abandonment cited by Canadian consumers is failure to offer promotions or discounts (60%), followed by lack of a clear returns policy (34%). Free or discounted shipping is also a major driver. “Those who offer a free shipping option see a 69% lift in conversions,” he said.

Australia’s ecommerce market benefits greatly from one of the most generous di minimis rates in the world: there are no import tariffs or duties on any item under $1,000 Australian. Consumers there also have high levels of disposable income, and goods sold at retail are expensive due to labor costs.

Kent Allen, principal of The Research Trust, said Australia sees a lot of inbound ecommerce, not just from U.S. retailers but from around the world as well. “The leading Australian brands have been somewhat slow to adopt ecommerce and omnichannel, and they’re not as customer centric,” he said. “Items cost more, there’s a limited selection and the experience in store is not great, so there are lots of reasons to go online.

Chris Boyle, president and CEO of Access Technology Solutions, said there are a number of factors that make Japan a booming ecommerce market: consumers there buy everything online; broadband mobile penetration is huge; an advanced delivery network; an affluent population; and ubiquitous use of credit cards.

He also said Japanese consumers have extremely high customer service expectations, so the entire experience needs to use the white-glove treatment.

“We’ve gotten calls from Japan and been told, ‘There’s a footprint on the box, we can’t ship it,’” Boyle said. “To us is might seem minor if the box isn’t damaged, but there’s no way they’re going to deliver it. The delivery person takes off their hat, bows and hands them the box.”