Happy Returns Network Expands to 2,600+ Locations in FedEx Deal

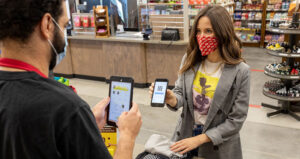

After parting ways with Amazon last year, FedEx is now jumping deeper into ecommerce returns, much as Amazon did with Kohl’s, by adding Happy Returns bars to 2,000+ FedEx locations, including 300 inside Walmart stores. Unboxed returns will be accepted from 150 different retailers when the program launches at the end of October.