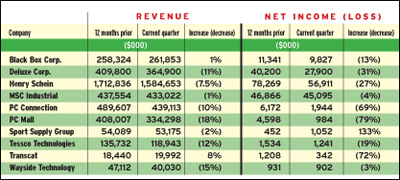

The Fourth Quarter of 2008 was Not Pretty, to say the least. Among the publicly traded business-to-business merchants tracked by Multichannel Merchant, nearly all ended 2008 as losers. Transcat and Black Box Corp. were the only mailers tracked that showed quarterly sales increases.

As for bottom line efforts, all companies tracked reported losses, except for Sport Supply Group.

How bad was the fourth quarter? It was pretty bad, says Stuart Rose, managing director for Wellesley, MA-based investment bank Tully & Holland. “In my time following this index, this is the worst quarter ever.”

Net income rises at Sport Supply

Quarter ended: Dec. 31 The facts: Fourth-quarter net sales for the marketer of institutional sports equipment totaled $53.2 million, compared to $54.1 million for fourth-quarter 2007. The decrease in net sales was primarily attributable to a $1.0 million decrease in catalog group sales. At least the merchant posted a surge in net income, which jumped 133%, to $1.05 million, from $452,000. The skinny: Sport Supply Group is responding to the financial crisis “by paying down debt and consolidating operations,” Rose says.

Schein’s sales slip

Quarter ended: Dec. 27 The facts: Medical, dental and veterinary supplier Henry Schein saw its fourth-quarter sales fall 7.5%, to $1.6 billion. Henry Schein’s net income for the fourth quarter decreased 27%, to $56.9 million, from $78.3 million. “Henry Schein believes the industry will continue to consolidate, and it is in a good position to capitalize on this,” Rose explains. The Melville, NY-based company eliminated about 300 positions from operations, or 2.5% of its workforce, this past November; it also closed several smaller facilities. The skinny: Better times are likely ahead for Henry Schein as it focuses on the health markets and the population is aging, Rose says.

PC Mall takes a fall

Quarter ended: Dec. 31 The facts: Computer reseller PC Mall reported fourth-quarter net sales of $334.3 million, a year-over-year decrease of 18%. Net income for the Torrance, CA-based merchant sank 79%, to $984,000, from $4.6 million. The skinny: You might not expect a chief executive to be happy with these numbers, but PC Mall president/CEO Frank Khulusi said in a statement that he is “pleased with our operating performance in the fourth quarter in light of the economic weakness that is well known and widespread.” Specifically, Khulusi said he was proud of the way that his team enabled PC Mall “to deliver increased gross margins and tighter operating expense controls.” Gross profit margin for the quarter was 13% compared to 11.7% for the quarter in 2007, a significant improvement. This shows that “even in difficult quarters you can make improvements,” Rose says.