Many of us in this “want-it-right-now, on-demand” culture seek levels of sophistication in marketing that we’re not prepared for. It’s as if we think we can run a marathon without having learned to walk beyond a few steps.

But what’s really involved in getting to the level of sophistication we seek so that we can become a truly customer-centric retail organization? If we can’t start with the bells and whistles, can’t design a fully integrated, cross-channel program, such as Best Buy’s RewardZone or its highly targeted, triggered e-mails, what can we do? And how can we get there from where we are now?

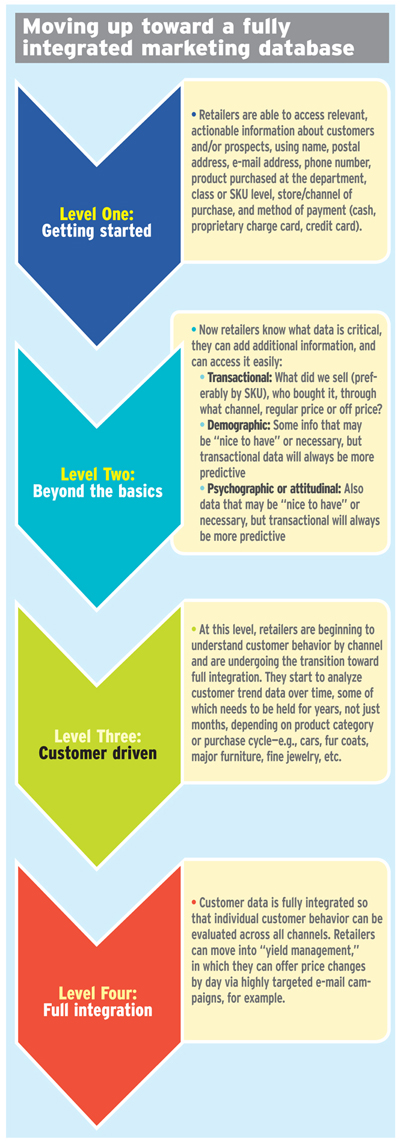

The four degrees of customer centricity cover how to start small, evolve, and grow into a fully integrated, multichannel retailer.

As the marketing database becomes more fully developed, it enables retailers to become more targeted. With highly targeted capabilities, retailers can market to customers with appropriate and highly relevant offers in their channels of choice. They can also unearth new opportunities for revenue in previously hidden niches, reduce customer touches while increasing response and revenue, and provide a seamless interface with the company regardless of channel to customers.

LEVEL 1: GETTING STARTED

In order for a company to become truly customer-centric, it needs a customer marketing database.

But getting started is a formidable task. What has often kept store retailers from entering database marketing in the past is the knowledge that their business changes daily with or without customer data. These retailers are already viewing:

- Daily/weekly sales reports focused on departments, class or SKUs

- Merchandise data and customer data, although those data may be accessible only in silos

- Reports that enable them to manage on the averages (average sale, average sale per square foot, etc.), transitions to managing on the differences (the differences between and among customers and customer segments)

- Mass-marketing information that has given them the opportunity to move to more customer-focused marketing by media and channel.

These retailers have often already sent some form of direct mail using their customer files, some by targeting customer segments and others by using zip-code or geo-demographic coding.

Many retailers who are ready to embark on the road to building a marketing database already know that customer information management (CIM) is more than direct mail (postal or e-mail); it’s a resource, not an end in itself, and they know that they need to seek advice from the professionals in retail CIM.

What’s more, retailers new to CIM have probably learned that the best way to establish a program is to build a team that’s responsible for:

- Building and using CIM resources for metrics analysis and tracking

- Developing relevant, additional market research

- Creating the messaging, including creative and production for print, broadcast, electronic and Internet

- Selecting media relevant to the channel

- Managing a combination of carefully selected and skilled staff and third-party business partnerships with sub-specialists — database designers, POS/CRM vendors, social scientists experienced in business-to-consumer issues.

Before you choose or hire the CIM marketing leader to head up this team, you need some critical elements for success in place, including:

- A champion in senior management, preferably the CEO

- A commitment to allotting the staff resources from each department (IT, store operations, merchandising and finance/credit) to work in a cross-functional team

- The decision to hire a database support staff and/or outside resources, both technical and analytical

- The budget to build, maintain and staff the marketing database

- A reasonable time frame to collect enough CIM data for initial analysis

- A decision to hire or appoint a CIM leader who will head up the training of the CIM staff, as well as management, on how to use customer data as a business decision tool.

In choosing a CIM marketing leader, you need to look for someone who knows the critical questions to ask, namely:

- What should we do? How should we do it? How soon can we do it?

- What is doable today?

- What foundation should we put in place to support the future?

- What metrics should we employ to measure our performance? And what are the paybacks to offset the expense of the database?

- What other related expense reduction and improvement can be expected from an investment in CIM?

- What are the potential revenue growth opportunities with CIM?

Finally, the CIM marketing leader can execute what I call the five I’s for customer data success:

- Infrastructure: What staff skills, hardware and software tools must be in place in order to get started?

- Integration: What systems/resources are needed to house the data, what data is now accessible, how can these data elements be brought together to start the CIM database?

- Insights: Can we profile and segment customers? Which programs or promotions aren’t working and why?

- Interpretation: What types of marketing programs should we create?

- Implementation: How can we apply our CIM learning for merchants, advertising/marketing, operations, management, real estate, customer service/call centers?

LEVEL 2: BEYOND THE BASICS

At Level Two, retailers begin to capitalize on their investment. They know, for example, what data they have or have access to, namely:

- Transactional: What did we sell (preferably by SKU), who bought it, through what channel, regular price or off price?

- Demographic: Maybe “nice to have” or, in some cases, necessary, but transactional will always be more predictive

- Psychographic or attitudinal: Maybe “nice to have” or, in some cases necessary, but transactional will always be more predictive.

Second-level retailers must also recognize how to implement basic marketing database programs and metrics, for example:

- RFM (recency, frequency and monetary), which becomes even more predictive when P for product data is added, at SKU level if practical

- Test and control, because all communications with customers can and should be measured

- Market segmentation using customer hierarchy and other segments that are pertinent to the retailer

- CIM-informed media and communication channel decisions.

Although these retailers know that their primary role is to meet the “sales” plan, they also know that they must meet the “customer” plan. This requires marketers to acquire, convert, grow, retain and reactivate customers, regardless of their primary channel.

As such, they need to act as CIM advocates, sharing the customer information database with top management, merchants, advertising/marketing, operations, real estate and customer service/call center personnel.

Critical to this process is the measurement of every customer communication or sales support program. These measurements are immediately reported back to management in a PARR report:

- P: What was the event/problem?

- A: What action did marketing take; for example, what data were used to target and measure?

- R (1): What were the results?

- R (2): What is our recommendation to repeat/not repeat/revise?

To make the data palatable for nonanalytical executives, retailers on Level Two document the results with data illustrated in charts or other visuals.

Next Page: Level 3: Customer Driven

LEVEL 3: CUSTOMER DRIVEN

At Level Three, retailers are able to analyze customer behavior by channel and are beginning the transition to becoming fully integrated across channels, both from an analytical and customer perspective. At this point, the CIM staff can produce advanced analyses of all campaigns, whatever the channel.

Level Three retailers at this stage have begun to develop specialized programs for customer clusters, like those targeting best customers or frequent buyers by Bloomingdale’s and Neiman Marcus. They are also actively using market research in order to apply valuable, proprietary data to their customer files.

Here retailers are most apt to begin stating publicly that their company has moved from being product focused to customer centric, as Best Buy did in 2003. A significant investment in CIM has already occurred.

LEVEL 4: FULL INTEGRATION ACROSS ALL CHANNELS

It’s hard to say which retailers have achieved this level of sophistication. But there are many anecdotal reports that Best Buy is close to realizing an integrated “zero based” approach across all channels to all marketing, merchandising and layout.

Getting close, however, does not mean that these retailers present a unified view of the company to customers in everything from services to marketing through the channels they prefer, to offering targeted discounts, to recognizing their value in special, unannounced ways.

Retailers that started in the catalog or Internet channel often have had more customer specific data to work with. But that does not necessarily mean that they were able to integrate all of those data into a robust customer information database.

So the jury is still out, but it’s clear that CIM has become the driver of retail sophistication and success as we move further into the next decade.

Francey Smith ([email protected]) is president of retail marketing consultancy Francey Smith & Associates.

Moving up toward a fully integrated marketing database

Level One: Getting started

-

Retailers are able to access relevant, actionable information about customers and/or prospects, using name, postal address, e-mail address, phone number, product purchased at the department, class or SKU level, store/channel of purchase, and method of payment (cash, proprietary charge card, credit card).

Level Two: Beyond the basics

-

Now retailers know what data is critical, they can add additional information, and can access it easily:

-

Transactional: What did we sell (preferably by SKU), who bought it, through what channel, regular price or off price?

-

Demographic: Some info that may be “nice to have” or necessary, but transactional data will always be more predictive

-

Psychographic or attitudinal: Also data that may be “nice to have” or necessary, but transactional will always be more predictive

-

Level Three: Customer driven

-

At this level, retailers are beginning to understand customer behavior by channel and are undergoing the transition toward full integration. They start to analyze customer trend data over time, some of which needs to be held for years, not just months, depending on product category or purchase cycle — e.g., cars, fur coats, major furniture, fine jewelry, etc.

Level Four: Full integration

-

Customer data is fully integrated so that individual customer behavior can be evaluated across all channels. Retailers can move into “yield management,” in which they can offer price changes by day via highly targeted e-mail campaigns, for example.