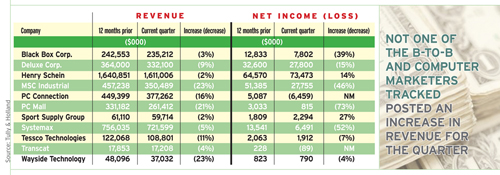

JUST WHEN YOU THINK THINGS CAN’T GET ANY WORSE, they do. The second quarter was even more dismal than the first for the business-to-business and computer marketers tracked for MULTICHANNEL MERCHANT.

Of the 11 publicly traded merchants tracked, all posted revenue declines. And only two — Henry Schein and Sport Supply Group — recorded bottom line gains.

The average revenue slide for the profiled companies over the previous quarter was 8.4%, says Stuart Rose, managing director for investment bank Tully & Holland. The computer products merchants fared worst — revenue in the segment fell 15%, compared to a decline of 6.4% in b-to-b segment.

And the revenue declines are modest when compared with dramatic deterioration in earnings. Overall net income for the profiled companies declined 18.4%, Rose says. The biggest declines came again in the computer products segment — net income declined by 39% or more for three of the four companies, “compared to a more mixed decline in the b-to-b segment,” he notes.

Bottom falls at MSC Industrial

Quarter ended: May 30 The facts: Fiscal third-quarter sales for maintenance repair and operations supplies merchant MSC Industrial Direct dropped 23%, to $350.5 million, compared to $457.2 million a year ago. The company’s net income sank 46%, to $27.8 million, from $51.4 million for the same period in 2008. Rose says a decrease in operating expenses was due primarily to reduced freight expense as a result of declining sales, as well as a fall in the company’s annual incentive plan and sales commissions due to the economy. The skinny: The expense reductions were partially offset by an increase in payroll from hiring more field sales reps, Rose says.

PC Mall falls hard

Quarter ended: June 30 The facts: Second-quarter sales at computer reseller PC Mall fell 21.1%, to $261.4 million, from $331.2 million. Net income declined a whopping 73.1%, to $815,000, from $3.0 million. Rose says this major shortfall in earnings was caused primarily by an increase of 30 basis points, from 86% in 2008 to 86.3% in 2009, in cost of goods sold as a percentage of revenue. The skinny: The deterioration in cost of goods sold can best be explained by a decrease in prices to remain competitive, while cost of goods remained relatively flat, Rose says.

Sales slide for Wayside

Quarter ended: June 30 The facts: Second-quarter sales for the Shrewsbury, NJ-based distributor of software for engineers and computer professionals sank 23%, to $37.0 million, from $48.1 million in the same period last year. Wayside did make improvements to operations during the period, as net income declined marginally by 4%, to $790,000, from $823,000. The skinny: SG&A expenses as a percentage of sales increased 150 basis points, from 6.4% in 2008 to 7.9% in 2009, as Wayside tried to reduce operating expenses in line with declining sales, Rose says.