WHAT A DIFFERENCE A YEAR MAKES. The publicly traded merchants tracked by Multichannel Merchant last year all posted revenue declines, and only two recorded bottom-line gains in the second quarter.

What happened this year? Just the opposite.

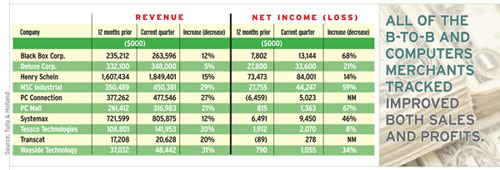

Of the 10 business-to-business and computer marketers tracked, all saw revenue gains and bottom line improvements. The average revenue increase was 18.5% and 22.8% for the b-to-b and computer products segments, respectively.

Nine of the 10 companies boasted double-digit sales gains. Wayside Technology led the way with 31% revenue growth, while Deluxe Corp. showed the most conservative growth at 5%.

Similarly, earnings growth was stellar. The b-to-b segment showed an aggregate increase in net income of 29.6% compared to the same period last year, says Stuart Rose, managing director for investment bank Tully & Holland. Transcat posted positive earnings after a loss in the same period last year.

Winners and more winners The computer products segment enjoyed remarkable earnings results as well, with Black Box Corp. gaining 68%, PC Mall gaining 67%, and Wayside Technology gaining 34%, for an aggregate measure of 56.3% year-over-year growth. PC Connection also showed impressive earnings after a loss in the same period last year.

Tessco Technologies has posted three consecutive quarters of year-over-year growth. It announced a 30% increase in revenue and an 8% increase in earnings for the period ended June 27, 2010. The revenue increase was largely attributed to growth in its network infrastructure, mobile devices and accessories business. Tessco appears to be capitalizing on growing demand for wireless Internet technology, specifically in the commercial sector, and will continue to take advantage of growth opportunities as the economy strengthens, Rose says.

Results for Systemax were significant, reflecting improved market conditions in the business-to-business sector, including improved spending. Sales results reached a record high at $805.9 million — an increase of 12% compared to the $721.6 million posted during same period last year. Business-to-business sales surged 35%.

Black Box posted a 12% sales increase, topping off at $263.6 million. Rose says Black Box should continue to see profitability and sustained growth with quality investments in organic growth and strategic acquisitions, similar to those seen over the past several years.

The strong sales and earnings of the profiled companies demonstrate that spending has returned to historical levels, and businesses continue to make great strides in improving their operating efficiencies, Rose says. The quarter’s financials are also “a firm indication that the recession has run its course,” he notes.

Despite the phenomenal second-quarter performance from the 10 profiled companies, Rose is reluctant to say the worst is over. “Growth was considerably slower in Q2 2010 (1.6 %) than Q1 2010 (3.0%),” he notes.

A legitimate concern exists for a double-dip recession, despite glimpses of spending and income gains, Rose says. On a positive note, while GDP growth does appear to be slowing, “we have now seen four consecutive quarters of year-over-year GDP growth through Q2 2010,” he says.