Engaging (or even reaching) the constantly-connected, multi-tasking consumer is not an easy feat. It’s even harder to understand the impact your advertising and marketing efforts have on moving this dynamic shopper toward purchase. Instinctively – both as advertisers and consumers – we know that advertising has an effect on our buying decisions, but at times it may be difficult to definitively prove (as advertisers) how and when our messages made an impact.

Recent research from Valassis – Motivating the Dynamic Shopper: Purchase Decisions In-Progress – helps shed light on the influence that advertising – and in particular digital advertising – can have all along the consumer buying journey. Looking at each purchase stage as a “moment” – thinking, wanting, watching, acting and shopping – the data unveiled the sometimes less-obvious influence of advertising at each stage.

Thinking

Yes, there’s a clearer link to the effect on revenue when the cash register rings the instant an ad deploys or a coupon redeems. But when did you first catch the buyer’s attention? Can you pinpoint the exact moment when the consumer started to consider buying a specific product or service and how the advertising contributed to that consideration?

Back in the 1970’s, Herbert E. Krugman wrote a paper on the effective exposure of media advertising, citing that a 3X exposure was needed to elicit a psychological response. According to Krugman, the first exposure elicits curiosity, the second exposure recognition and the third exposure decision.

Although the question of optimal frequency and the resulting exposure is still debated today, it does point to the idea of “priming” a consumer for purchase – providing them with a baseline understanding of the product or service that is being offered, that will then (hopefully) motivate action when the consumer encounters the product or service in the future.

In our study, we observed this consumer “priming” – 55% of surveyed consumers notice a relevant digital ad but don’t click, respond or buy immediately. This number grows to 66% for parents, 62% for Millennials and 60% for Gen Xers.

Source: Valassis Awareness-to-Activation Study. Insights captured from research fielded May 2016 – January 2017. Numbers are rounded. Valassis generation age segmentation: Millennial: born 1982-1998, Generation X: born 1965-1981, Baby Boomer: born 1946-1964. Parents defined as having children under age 18.

Although this merely scratches the surface of advertising’s impact and attribution, it does suggest that digital ads do begin to register with consumers even before clicking, responding or buying occurs.

Wanting

Incentives are powerful. Consumers – across generations – value saving money on items they purchase. Prosper Insights & Analytics 2017 data continues to show the strong influence coupons have on purchase decisions, ranking within the top three media influencers since 2010.

Valassis’ data also highlighted the power of a coupon. Surveyed consumers were asked what specifically in a digital ad will most make them want to respond, and the top two tactics selected focused on offers – more so than options to call the store, watch a video or go to a website. Coupons and discounts were even more compelling for Millennials, Gen Xers and parents.

Source: Valassis Awareness-to-Activation Study. Insights captured from research fielded May 2016 – January 2017. Numbers are rounded. Valassis generation age segmentation: Millennial: born 1982-1998, Generation X: born 1965-1981, Baby Boomer: born 1946-1964. Parents defined as having children under age 18.

What was even more interesting were the nearly 20% of respondents who stated that they may be influenced by the digital ad, but won’t click – highlighting again the sometimes “unseen” impact an ad may have early on the path to purchase.

Watching

Consumers are a fast-moving target. It’s not enough to place any digital ad on any device – you must think about whom you are trying to reach and where, how and when they are most receptive to your message.

For example, you may be quick to assume that millennials are only using their mobile devices, an assumption that has merit – especially since Nielsen found that in first quarter 2016, millennials ages 18-24 spent over 15 hours each week and millennials ages 25-34 spent nearly 14 hours each week with apps and the internet on their smartphones (versus 11 hours, 36 minutes spent for adults 18+).

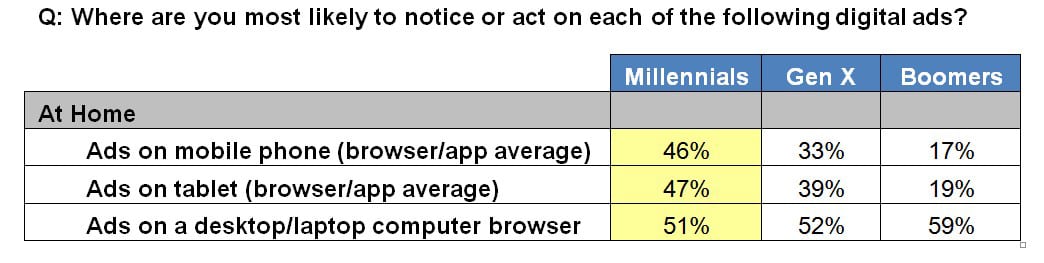

What is surprising is that while at home, millennials pay attention to digital ads across devices – whether it is on a desktop/laptop, tablet or mobile phone.

Source: Valassis Awareness-to-Activation Study. Insights captured from research fielded May 2016 – January 2017. Numbers are rounded. Valassis generation age segmentation: Millennial: born 1982-1998, Generation X: born 1965-1981, Baby Boomer: born 1946-1964. Parents defined as having children under age 18.

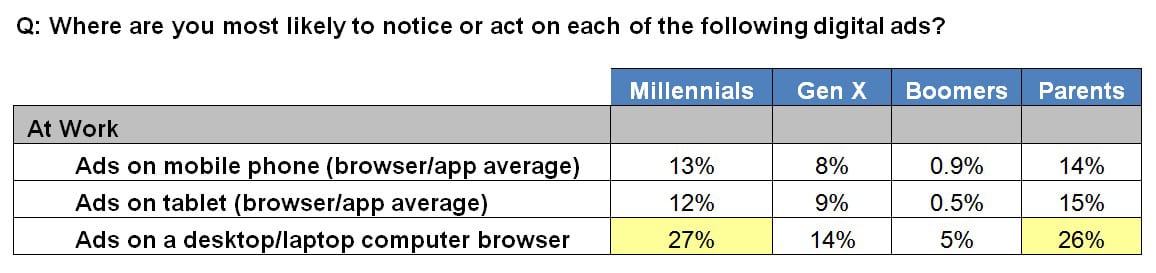

Although “At Home” is the top location where surveyed consumers – across generations – are most likely to notice or act upon digital ads, “At Work” is another likely location – particularly for Millennials and parents on their desktop/laptop computers.

This could be for a variety of reasons – a greater percentage of Millennials and parents may be in the workforce than older demographic segments. Or, given that nearly 37% of Millennials are now parents according to Scarborough Multi-Market 2015 Release 2 data from Nielsen, these consumer groups may simply be trying to balance work with personal needs – and are comfortable with leveraging multiple technology options to do so.

Source: Valassis Awareness-to-Activation Study. Insights captured from research fielded May 2016 – January 2017. Numbers are rounded. Valassis generation age segmentation: Millennial: born 1982-1998, Generation X: born 1965-1981, Baby Boomer: born 1946-1964. Parents defined as having children under age 18.

Acting

Although there are many ways to elicit a consumer response, one method may be integrating print and digital media with a consistent message.

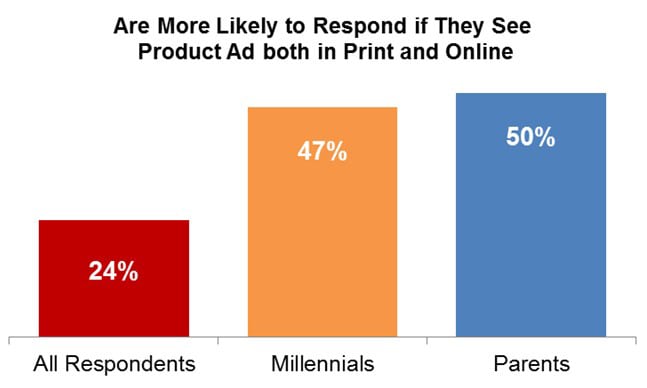

When surveyed consumers were asked how likely they are to respond to advertising when they receive ads for a product both online and in print, 24% of them said they are “more likely” to respond.

Digging deeper into the responses of Millennials and parents specifically, the study found that 47% of Millennials said they would be more likely to respond if they saw a product advertised both online and in print, and 50% of parents noted this.

Source: Valassis Awareness-to-Activation Study. Insights captured from research fielded May 2016 – January 2017. Numbers are rounded. Valassis generation age segmentation: Millennial: born 1982-1998, Generation X: born 1965-1981, Baby Boomer: born 1946-1964. Parents defined as having children under age 18.

One theory for this increase in consumers likely to respond refers back to the need for exposure to make an impression on the consumer – seeing a consistent message across media channels could help make the transition from curiosity to recognition to decision a more probable one.

While we don’t know exactly why Millennials and parents responded as they did, the data does suggest that an integrated approach may increase response – particularly for these audiences.

Shopping

We saw earlier that both location and device make a difference in capturing consumer attention to digital ads. Another factor that impacts response is the type of advertiser featured.

For boomer respondents, a desktop/laptop is the device on which they are most likely to notice and respond to digital ads across various categories. For Millennials and parents, ads on smartphones and desktop/laptops typically share their attention, with a few exceptions.

Research categories like Furniture and Home Improvement tend to see millennial, Gen X and parent respondents more likely noticing and responding to digital ads on their desktop/laptop; ritual categories like Fast Food and Pizza skew toward smartphones for these audiences.

Source: Valassis Awareness-to-Activation Study. Insights captured from research fielded May 2016 – January 2017. Numbers are rounded. Valassis generation age segmentation: Millennial: born 1982-1998, Generation X: born 1965-1981, Baby Boomer: born 1946-1964. Parents defined as having children under age 18.

These findings support the need for cross-device campaigns and optimization, tailored to the audience.

Summary

Media has an impact on the consumer, whether its effects are instantaneous or more subtle in nature.

Close the awareness to activation gap with greater understanding of what motivates this dynamic shopper throughout their path to purchase. By knowing where and how advertising – particularly digital media – impacts shopping and buying decisions, marketers can continue to hone their advertising plans to prime and ignite consumer action.

Julie Poast is Director, Campaign Solutions at Valassis