Many catalogs’ merchandise buyers are made up of customers who purchase only within certain merchandise categories. To determine if your house file includes a significant number of such buyers, you need to categorize your customers by the type of merchandise they buy, then measure the intersection or crossover between the merchandise buyer groups. If most of the buyers purchase only within a single group of merchandise and only a small percentage buy across categories then you have disjoint groups of buyers.

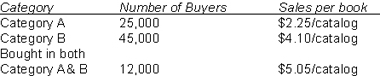

Catalogers need to know the merchandise categories of their buyers, the universe for the groups of buyers, and the relative value of different types of customers. For example:

This quick analysis tells you how many are in each category, how many bought across categories, and what was the relative value of each type of buyer.

What circulation actions can you take if you find you have different types of buyers?

The first step in modeling at the cooperative databases is to send them the separate groups of buyers and have them create a different model for each group. From there:

- If one group consists of gift buyers, you want to mail them more frequently in the fourth quarter and less frequently away from the holiday season.

- If one group is a much higher-value group of buyers, tailor your prospecting to find the high lifetime value buyers.

- Avoid prospecting for merchandise buyers with lower lifetime value.

- Create a separate catalog geared toward your best buyers. Increase the amount of merchandise geared toward your best buyers.

- Model you newest buyers separately, especially if you are a maturing catalog, to see if the recent customers are different from you established customer base.

How do you prospect for customers to grow your best merchandise niches? Several of the cooperative databases collect product-level data. Catalogers are finding product-level data very useful in data mining for customers who buy specific products through catalogs. Finding customers for specific kinds of products using the product-level data is very effective if the co-ops have merchandise categories that closely fit your customer’s purchasing.

And there are alternatives to product-level modeling:

- Use the buyers of certain products to model to find a prospecting universe of buyers. This has the advantage of allowing you to build based on very specific selections of products. Building co-op database models based on specific responder files is a proven model-building strategy.

- Build a table of catalog titles that are close to the merchandise mix you want to target. Have the co-op databases model based on past purchases from catalogs tightly focused on your product category.

- Model your overall buyer file, then model responders to a subset of your merchandise, and look at the differences in the names provided. You may identify selects that allow you choose your best prospects based on the demographics of your merchandise buyers.

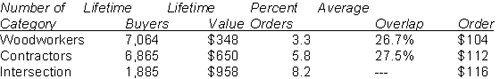

Here’s a case study of a tool catalog that includes at least two disjoint groups. It sells products for woodworkers (who may be small-business owners or hobbyists), for builder/contractors, and for do-it-yourselfers. The catalog merges these groups and mails them a single catalog. Is there a way to either expand the business or cut costs by separating woodworkers, contractors, and DIYers?

- The groups can be separated by using a table of products or brands that are purchased only by woodworkers, another table of products or brands that are purchased only by contractors, and a thirds table of products, brands, or product categories (portable power tools, for instance) that are purchased by all three groups—woodworkers, contractors, and DIYers.

- You could divide the catalog into separate woodworker, contractor, and DIY catalogs, yielding significant cost savings.

- You can model the names that bought DIY products at the cooperative databases to find a prospecting universe that is new, is unique, and stretches outside the vertical list rental universes.

The key is to look at the business as a series of disjoint universes of products (builder products, woodworker products, and DIY products) and customers (builder/contractors, woodworkers and DIYers). Breaking down the book into its component parts and breaking down the customer base into discrete subsets of tool buyers will give an efficient series of catalogs with smaller page counts, allowing you to stretch the marketing dollars a lot further. It also allows you to build a DIY catalog aimed at non b-to-b tool buyers. You can tailor the DIY catalog with lots of higher-margin products that just wouldn’t fit in a catalog aimed at professional contractors as well as hobbyists.

Here are the basics of customer analysis by class of products.

How do you analyze your buyer base?

- Build a table of products that define a buyer as a “woodworker” or as a “contractor.”

- Tabulate the buyers by number of buyers, lifetime value, lifetime orders, average order, and percent of overlap with the other product groups.

- Create overlap tables. Remove the buyers that intersect between two product groups.

- Model the names at the co-op databases by type of product.

- Mail the segmented names by assigning key codes to the categories.

Critical to your catalog’s strategy is knowing whether your catalog’s customers are a single homogenous group or are made up of disjoint groups. If you find your buyers are made up of disjoint groups, you can take a number of tactical actions to increase your prospecting universe, change your buyer and prospecting circulation plans, and split your catalog to lower your in-the-mail costs. Drilling down into the issue of whether you have disjoint groups of buyers will teach you a lot about your business and will trigger many actions that will increase your sales, cut your costs, and raise your profits.

Jim Coogan is president of Santa Fe, NM-based Catalog Marketing Economics.