The holiday season is the most important season for prospecting for most consumer catalogers. Traditionally, prospecting was primarily a matter of mailing to names from rented or exchanged lists. These lists were typically selected based on similarities regarding merchandise, price points, average order, presentation, and customer demographics.

A traditional merge/purge was structured to include all prospect lists in the same priority just below your own buyers and inquirers. Names appearing on two or more lists, called multibuyers or multis, were randomly allocated among the specific lists to ensure that these more responsive names similarly influenced each list. This created a “level playing field” that allowed a valid comparison among all lists and “easily” readable results.

This all changed, of course, with the advent of the cooperative catalog database. Most catalog companies that rent their list have contributed their transaction information to at least one co-op database.

As a result, you need to rethink the traditional approach to segmentation and merge/purge structure. It is no longer appropriate to apply an all-or-nothing approach to evaluating and mailing prospecting names. Instead, by using the merge/purge and secondary optimization, catalogers can identify the performing names to mail and the loser names to pitch.

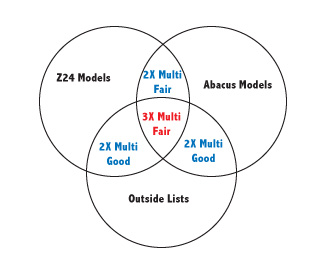

Cooperative database models should not be viewed as just another list in the merge/purge. You can use their interaction with the outside lists to identify hig- performing names. There are also cost implications, since names from models cost substantially less than rented names and substantially more than exchanged names. The models from each cooperative database and the outside lists should be placed into separate priority groups within the merge/purge to identify and isolate the crossover names among the groups as discrete types of multis. The chart below illustrates interaction between these groups.

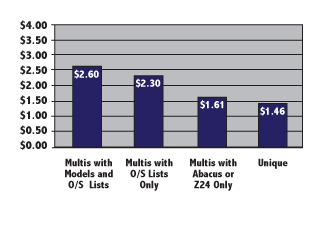

Not all multis are created equal. By creating discrete groups of multis, you can identify the superior names. This merge/purge priority also improves the ability to evaluate the less costly co-op prospecting models. As indicated in the chart above, prospect names in multiple cooperative models and outside lists are most responsive.

The chart below demonstrates the response rates to the various types of multis from a recent mailing. These results are very typical of catalogers with a broad offering. Results can vary with a highly vertical, niche catalog that appeals to a very narrow, committed audience where propensity to purchase by mail is secondary to their interest in the niche product.

After identifying the multis, you are still left with the unique names. So what do you do with those names to improve results? The performance from the unique names must be carefully tracked and evaluated. By evaluating unique names separately, you may come to a very different conclusion about the value and mailing strategy of a list.

First, you may choose to mail only the multis and discard the unique names. Before doing so, however, it is worth working with a co-op or list services provider to optimize the names so that you can identify performing names from nonperforming names. Depending on the value of the unique names, you may decide not to rent that list in the future since you are picking up the multi names from another source. Finally, you may choose to exchange lists aggressively to create multis against high-performing models, reducing your mailing costs and discarding the nonperforming unique names.

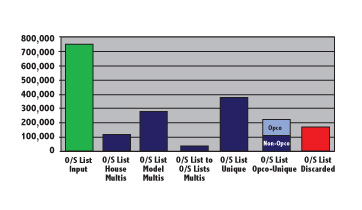

The chart below demonstrates what can happen to outside list names as a result of the merge/purge structure previously described and use of optimization on the unique names. In this particular case, 746,100 outside list names were put into the merge/purge. Of those, 112,724 names hit the house files and were mailed under a specific key code. 280,611 names became multis with models, leaving 382,173 unique names. Of these 382,173 unique names, 108,766 names were determined to be mailable above breakeven;the remaining 273,407 names were sent to a co-op (Abacus in this case) for optimization. Through the optimization process, 106,986 nameswere identified as meeting our mailing criteria. In the end, 166,421 names (22%) were discarded and never mailed.

At the end of the day, the cataloger may have paid $25,000 ($0.15/name) for the names that were discarded. With the added knowledge that these names were not likely to perform close to breakeven, would you rather spend $25,000 on discarded names or $100,000 ($0.60/book mailed) to mail these names a catalog? There is much to be gained by carefully structuring your merge/purge, priority groups, and segmentation to isolate the unique names and multis based on family group interaction. Through testing, you can identify significant groups of nonperforming unique names to discard. The more successful you are at pitching the losers, the higher your prospecting response rate will be.

Michelle Farabaugh is a partner with Lenser, a San Rafael, CA-based direct marketing consultancy.