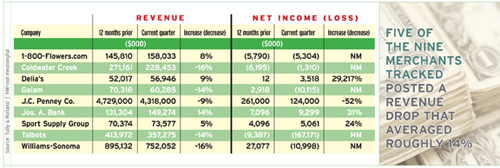

There Were More Losers Than Winners among the consumer companies tracked by Multichannel Merchant. Five of the nine merchants followed posted third-quarter losses in sales revenue that averaged nearly 14%.

Of those five, J.C. Penney was the only marketer to report a positive net income, yet it was a 52% drop over the same quarter in 2007. The four companies reporting sales gains averaged 9% increases.

Stuart Rose, managing director for Wellesley Hills, MA-based investment bank Tully & Holland, which tracks the companies for Multichannel Merchant, says the third quarter was difficult for most business-to-consumer marketers. “With consumer spending and confidence low, retailers nationwide experienced little growth in sales,” he says. “The current financial standing of retailers is indicative of these negative trends in retail sales and the economy in general.”

For instance, Talbots dealt with the underperformance of its J. Jill division and posted “the most dismal net losses due to the anticipated sale of this division,” Rose adds.

Sales up at Jos. A. Bank

Quarter ended: Nov. 1 The facts: Third-quarter sales for men’s apparel cataloger/retailer Jos. A. Bank Clothiers rose 14%, to $149.3 million, compared with $131.3 million for the period last year. Direct marketing sales, however, decreased 11.4%. Same-store sales for the quarter ended Nov. 1 increased 7%. The skinny: Jos. A Bank continued its expansion by opening 38 new stores in the first three quarters of 2008. The company reported $9.3 million in profits, about a 31% gain from $7.1 million for the quarter last year.

Direct sales dip at Delia’s

Quarter ended: Nov. 1 The facts: Sales at teen products merchant Delia’s increased 9%, to nearly $57 million, compared with $52 million for the third quarter of last year. Sales in the direct segment — the catalogs and Websites of Delia’s, Alloy and CCS — fell slightly, to $24.4 million, down from $24.7 million. Delia’s posted net income of $900,000, compared to a net loss of $2.7 million in 2007. The skinny: The company dealt with mixed results over 2008 and is restructuring its company and positioning, Rose says. Delia’s, which sold CCS to Foot Locker in November, “is looking to focus on the strengths of its Delia’s brand, while controlling costs and increasing its competitive standing.”

Tough quarter for J.C. Penney

Quarter ended: Nov. 1 The facts: J.C. Penney saw total third-quarter sales slip 8.7%, to $4.31 billion, compared to $4.73 billion for the same period in 2007. Net income sank 52%, to $124 million from $261 million for the third quarter last year. For the three months ended Nov. 1, the general merchant’s same-store sales decreased 10.1%; Internet sales decreased 0.3%. The skinny: The company was able to decrease inventory levels by 9% through additional clearance promotions and by monitoring merchandise movement, Rose says.