THE THIRD QUARTER OF 2010 REVEALED CONSIDERABLE RENEWED OPTIMISM for business-to-business and computers marketers. Consumer merchants, however, fared poorly in comparison.

Starting with the good news, the prodigious performance from the b-to-b and computer merchants is a promising indicator of improving conditions, says Stuart Rose, managing director with investment bank Tully & Holland, which tracks the companies for Multichannel Merchant. “It’s proof that businesses were able to execute measures to achieve profitability during a recovering economy.”

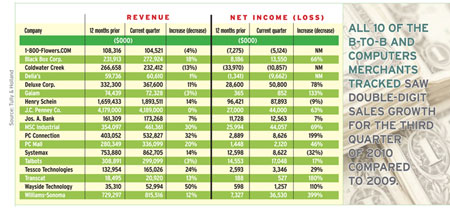

Average revenue gains reached 17.8% and 30% for the b-to-b and computer products segment, respectively. Revenue growth for the b-to-b segment was 15.2% higher than GDP growth of 2.6% for the same period.

All 10 of the business/computers companies reported double-digit sales growth compared to the quarter in 2009. Wayside Technology led for the second consecutive quarter with 50% revenue growth. Business forms mailer Deluxe Corp. had the lowest, yet still a respectable uptick of 11%.

Earnings growth was more impressive: The b-to-b segment recorded an aggregate increase in net income of 52.7% compared to the same period last year, and four of the six companies showed positive earnings growth. Test, measurement, and calibration instruments distributor Transcat led the b-to-b gainers with 180% earnings growth during the quarter.

The computer products segment reported average earnings growth of 105%. PC Connection was the quarter’s big winner, with a 32% rise in sales compared to the third quarter of 2009, and 199% growth in net income.

Meanwhile, consumer merchants registered remarkably soft sales results: Half of the profiled b-to-c companies reported either revenue declines or no growth. Kitchenware retailer Williams-Sonoma led the group with nearly 12% revenue growth while Coldwater Creek’s sales sank nearly 13%. Just three of the eight consumer companies recorded net losses. Williams-Sonoma also topped the earnings list for the segment with $36.5 million, compared to $7.3 million for the third quarter in 2009.

Conversely, Talbots saw its sales drop 3.2%, but the women’s apparel merchant improved its bottom line by lowering interest expenses after paying down its debt by 86%. Talbots will most likely not see substantial improvements during the fourth quarter, Rose predicts. But he notes that the cataloger/retailer is implementing an enhanced marketing campaign to drive sales.