MERGERS AND ACQUISITIONS ACTIVITY IN THE MULTICHANNEL WORLD has been pretty dead in 2009, according to Lee Helman, managing director for investment firm Financo.

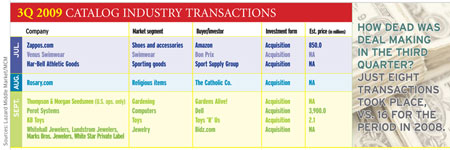

How dead? The third quarter saw half the deals — eight vs. 16 — compared to the period in 2008.

Blame the slowdown on a gap between sellers’ and buyers’ value expectations, Helman says. “Some of the gap was created by weaker than planned performance in the fourth quarter of 2008 due to the macroeconomic trends and turmoil.”

As a result, Helman says, fewer catalogs came into the market in 2009 because they would have had to sell off depressed 2008 earnings. What’s more, Helman says liquidation analyses revealed that some companies could actually net more if they liquidated rather than agree to be sold at steep discounts.

The demise of home and garden products cataloger/retailer Smith & Hawken is a good example of this, Helman says. Parent company Scotts Miracle-Gro Co. shut down Smith & Hawken in July after failing to find a buyer for it.

Potential buyers weren’t eager to get in the game either, he says. Many were focused on circulation strategies, making inventory commitments and preserving their core businesses.

“An acquisition, while possibly attractive at low valuations, could have brought a lot of risk to a company’s core survival,” Helman says, “so most buyers were extremely cautious about not getting distracted by due diligence processes, negotiations, integrations and system conversions.”

Activity picked up at the start of the fourth quarter of 2009, Helman says, with a number of assets being selectively and quietly shopped. “This could be happening as a contingency plan ahead of a possible post-Christmas liquidation, or it could also be a way for companies struggling with liquidity to raise additional capital and buy some time with their lenders,” he says.

Then again, he notes, several companies reported good third quarters “and might just be drinking from the fountain of courage again.”

Pent-up demand on both sides

Helman expects 2010 to be much more active, M&A-wise. “Credit has slowly opened up a bit, and there is a big pent-up pool of capital. Private equity has to put funds to work, and strategics are sitting on record levels of cash. Expect a big rebound in activity in 2010 as companies feel good about having stabilized their businesses and taken measures to be lean and mean.”

David Solomon, co-CEO of investment firm Lazard Middle Market, agrees. “There is some pent-up need by people who own quality companies who have been waiting to sell when the conditions are right for a resurgence in M&A.”

Most of the fourth-quarter deals were largely Internet transactions, Solomon says. On the direct side, many consumer businesses shrank and had declines in profitability, he says, and it became “increasingly difficult to arrive at valuations interesting to both shareholders and buyers.”

But now, Solomon says, “We have some stability in overall corporate performance, and many strong companies actually grew through the recession.”