The cost of catalog paper is likely to pick up in the second quarter, at least if the mills have their way. Paper mills AbitibiBowater and Kruger, for instance, have announced an increase of $3 per hundredweight (cwt) on their #4 and #5 grades.

And Paul Buohl, manager of estimating and purchasing for direct marketing production consulting firm EU Services, expects to see a 3% to 4% increase in both uncoated and coated freesheet in the second quarter.

But some aren’t sure that these potential price hikes will stick, given that demand hasn’t exactly rebounded yet.

Many mills have been hinting at an April 1 price increase for some time now, says Dan Walsh, vice president of catalog/publication papers at distributor Bradner Smith & Co. But unless there’s a real increase in demand for paper, or the mills are willing to curtail supply even more, he says, “there’s little chance of this increase being sustained.”

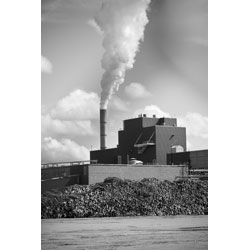

Mills are desperate to raise prices because their costs have gone up. Also, they won’t have the cushion of the so-called “black liquor” tax credit this year.

Paper mills were able to take advantage of an alternative fuels provision tax credit last year because they can use a pulp byproduct (a sludgy liquid known as “black liquor”) to power their mills. But the Internal Revenue Service was overwhelmed by the payouts to mills, and it is excluding the paper industry from the tax credit for fiscal 2010.

This is going to be a problem, Walsh says, because the tax credit allowed some manufacturers to stay afloat last year and to operate lesser performing facilities.

“But the bottle of black liquor is now drained, and the mills are waking up with a big hangover,” he says. “One could see more curtailments and possible permanent mill closures this year as U.S. mills have to go it without the subsidies.”

A potential tariff on imports from Asia

Yet another factor is the possibility of penalties against Asian coated imports. The U.S. Department of Commerce issued a preliminary ruling whereby tariffs will be imposed on coated paper imports from China and Indonesia to offset the unfair advantage provided by subsidization.

Appleton Coated, NewPage Corp. and Sappi Fine Paper North America, together with the United Steelworkers (USW), filed unfair trade cases last September with the U.S. Department of Commerce and the U.S. International Trade Commission. The case claimed that certain coated papers from China and Indonesia had been dumped and subsidized, resulting in injury to the domestic industry and its employees.

While Walsh says the lawsuit concerns only sheet-fed paper, not rolled paper, it is still significant. “Just as this case has been taking place over the last several months, Chinese and Indonesian imports have slowed.”

If the ruling does end up going through and tariffs are imposed, “it will diminish imports even more,” Walsh adds. “As the lack of availability of this cheap paper increases, so will prices.”

Dave Goldschmidt, vice president of marketing, catalog division for paper brokerage Strategic Paper Group, agrees that the situation in China and Indonesia could lead to a tighter supply on the sheet side of the business.

What’s more, he says a strike by Finnish dockworkers has shut down all ports, and if this continues it could force paper mills to shut down machines. This, too, could lead to a tighter supply on rolls and sheets, Goldschmidt says.

But it really boils down to demand. Although demand has shown some improvement in the past year, keep in mind that last year was one of the worst economic periods in recent history, Walsh says. So to get excited about the paper demand increases this year is “to get excited about losing five pounds when you gained 10 last year.”

One of reasons that demand is slightly on the rise, Walsh explains, is that inventories have been depleted and new orders for paper had to get in the pipeline.

Round II of the U.S. Postal Service summer mail sale could spark some demand, he adds. And with prices for paper still at near-record lows for some grades, Walsh believes catalogers will take advantage of this to increase circulation and/or page counts.

If this happens, and Walsh thinks it will, “supply could also become tighter and could lead to actual paper increases that are justified considering demand.”