Why Ad-Attributed Sales and ROAS Contribute to Inefficient Investment

U.S. retail media spend crossed $40 billion in 2022, per Statista, with Amazon taking the lion’s share. While the size of spend is staggering, what has been equally mindboggling is the speed at which retail media has reached these levels.

It took search 14 years to reach $30 billion, social took 11 years, and retail media only five. Projections suggest that by 2024 it will account for nearly one in five digital advertising dollars.

Spending Has Surged; Has Measurement Kept Pace?

Retail media has grown under a confluence of factors which make it very difficult to measure. The biggest reason is that both the advertising and sale take place within walled gardens. Due to the shifting privacy landscape, there are limited outside options for tracking the customer journey across platforms.

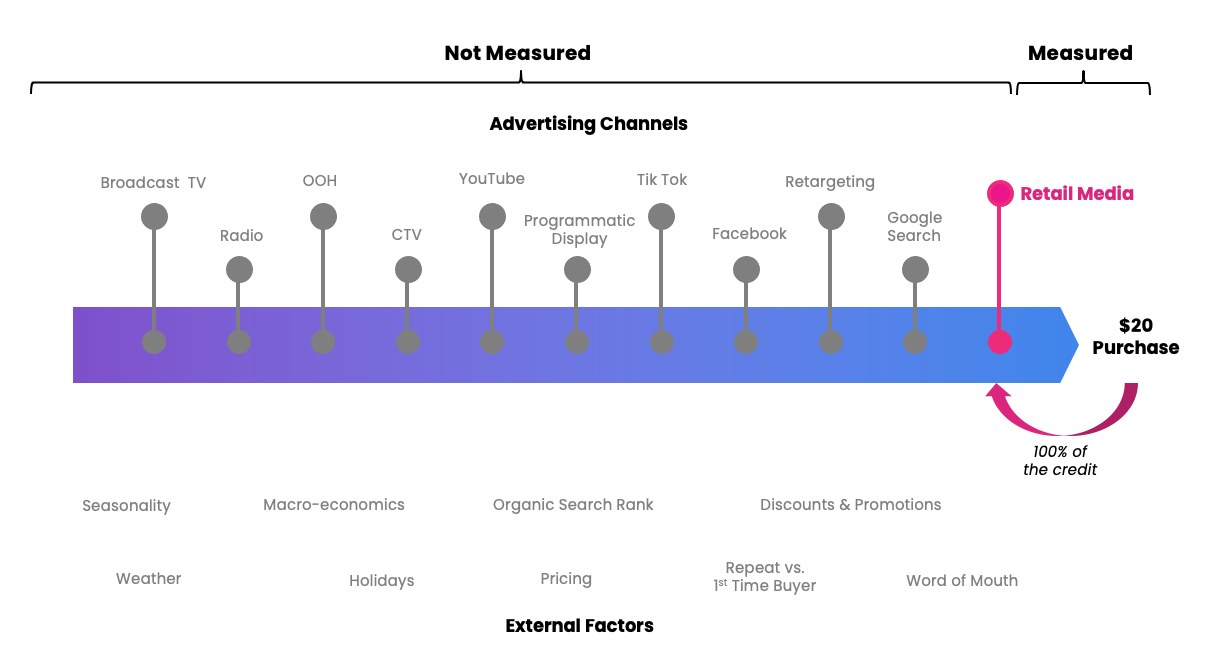

The net result of these conflicting trends toward rapid growth and limited data availability have pushed most brands to default to platform-provided reporting (e.g., Amazon Ads reporting ad-attributed sales.) This is a very simplistic approach to attribution. If someone saw or clicked an ad, then purchased within the look-back window, the ad gets 100% credit for driving that sale. When viewed more broadly among all factors which influence a purchase, the shortcomings become obvious.

Given how close retail media sits to the point of purchase, it can easily take credit for sales being influenced by upstream advertising or external factors like seasonality. There is an analogous set of learnings that came from the early days of digital, as brands shifted from last-touch (LTA) to multi-touch attribution (MTA).

At the time, search and retargeting sat closest to the point of purchase, and LTA credit made their performance look stellar. These channels almost always were the last touch before a user converted. As brands shifted to MTA or used marketing mix models (MMM) to measure these new digital channels, they came to learn that these channels were being massively over-credited by LTA or other direct attribution approaches.

But there was a harder lesson still being learned in the early days of digital. Ads on many of these channels were being purchased using bidding algorithms that were optimizing towards that now obviously flawed KPI. The result was that the algorithms were blindly optimizing AWAY from incremental sales. Instead, they were directing bidding towards users who were often the most likely to convert organically, so they could steal the conversion credit (and make results look amazing).

The $40 Billion Question

Are we seeing the same thing play out with retail media?

To provide a comparison to the single-channel direct attribution provided by retail media platforms, we leveraged multivariate time series models which could control for other advertising channels and for external factors.

These types of models have a long history in attribution and are the foundation of most marketing mix models today. They are well suited to retail media because they can make use of readily available aggregate time series data; control for spend on other media channels; and control for factors outside of paid media (promotion, organic search rank, macroeconomic factors, seasonality, etc.). The results below are an aggregate of these models across a broad set of brands and campaigns.

Before we dive into the results, let’s establish a few operational definitions to ensure we are all speaking the same language:

- Incremental Sales: Sales that were incrementality driven by retail media after controlling for spend on other channels and external factors like seasonality, promotion, etc. These are sales that would have otherwise not occurred without the influence of retail media.

- iROI: Incremental return on investment calculated as incremental sales/advertising spend

- Ad-attributed sales: sales that were attributed to advertising by the retail media platform (e.g., clicked ad, purchased product within a look-back window) without controlling for any outside advertising exposure of factors

- ROAS = Return on Advertising Spend, calculated as ad-attributed sales/advertising spend

Now, let’s look at the results:

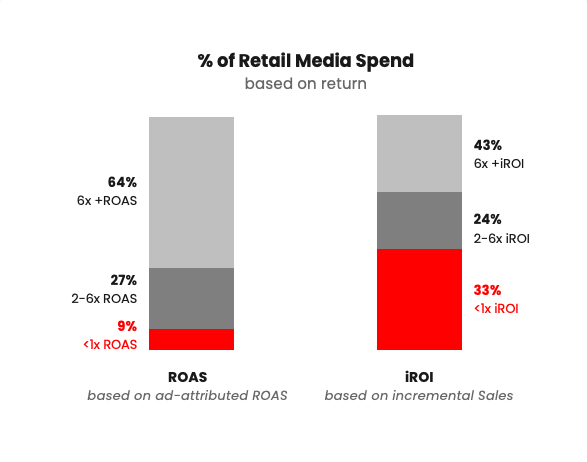

Retail media can be incredibly efficient: 43% of the spend had an iROI of 6x or greater, on par with other highly efficient media channels.

However, not all of it is efficient: 33% of the spend had an iROI <1x, suggesting the brands likely got less than a dollar back for every dollar they invested.

There is a silver lining to the second point – and a huge optimization opportunity that adds up to over $10 billion worth of investment that could be optimized. If those poor performing campaigns can be identified quickly, and budget reallocated to stronger performing campaigns, the brand can generate significant incremental sales with the same working budget.

Now not all campaigns with iROI of <1x should be seen as a “bad” investment. Some may serve a strategic value, like bidding on branded keywords to protect the brand from competitive conquesting. But there is certainly some additional juice that can be squeezed out of retail media with some more robust measurement.

This begs the question though, why is there so much opportunity for optimization within retail media? This really comes down to whether the single channel direct attribution commonly adopted today is effective at identifying incremental sales. The same set of retail media campaigns looked much better from a ROAS perspective, with only 9% of campaigns having a ROAS <1x. Anyone only looking at just ROAS would naturally come to think they’ve optimized their spending efficiently, when the reality runs counter to that.

Put another way, the current approach obfuscates the opportunity by over-crediting campaigns that don’t drive incremental sales, while under-crediting those that do.

What’s Next?

There’s a maturity curve to climb when measuring retail media, and we are still in the early days. That said, there is a wealth of alternative approaches to measuring retail media besides what is being used today. They are derived from the hard-won lessons from other media channels that we can apply here to avoid making the same mistakes twice.

Skye Frontier is Senior Vice President of Growth at Incremental