THE THIRD QUARTER OF 2009 DIDN’T BRING MUCH RELIEF for those expecting an economic rebound. The financial results of the profiled companies show further erosion in topline revenue, says Stuart Rose, managing director with investment bank Tully & Holland, which tracked the companies for Multichannel Merchant.

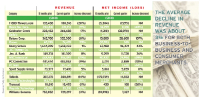

For the business-to-business and computer marketers, the average decline in revenue for b-to-b was 3%; for the computer catalogers it was nearly 11%. As for third quarter earnings, the b-to-b segment showed an average increase in net income of 13.7% over the prior period, Rose says, “with only two of the seven companies highlighted showing declines in earnings.” The computer products segment fared worse, with an average decline of 37.3% over the period in 2009.

Consumer and business spending has stagnated, which explains the lower sales, “while b-to-b companies have largely adjusted and have cut costs to keep pace with declining revenue,” he says. The computer products segment, however, is still struggling with weak consumer and business demand.

The consumer merchants tracked saw an average decline in revenue of 2.8% for the third quarter. Consistent with reported revenue, earnings results were mixed. Although four of the eight profiled companies posted higher earnings than the prior year, these results indicate continued weakness in the sector as consumers held back on purchases, and companies struggled to improve operations in line with falling sales.

Two companies — Deluxe and Gaiam — benefited from being compared to a quarter last year with an impairment charge. The clear winner for the quarter? That would be Jos. A. Bank, which in the third quarter posted its 14th quarterly year-over-year increase in both revenue and earnings. The menswear cataloger/retailer, which last month announced it was expanding into the tuxedo rental market, has managed to attract strong customer demand while streamlining operations throughout the economic downturn, Rose says.

What’s the outlook for the first half of 2010? Rose predicts the start of a turnaround period for both business and consumer merchants. At some point soon, he says, consumers and companies have to return to the market to replace depleted inventories, “which have shown seven straight quarters of decline.”