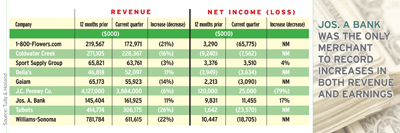

If You Thought the Consumer Catalogers Tracked Would Fare Better in the first quarter than the business-to-business marketers, think again. Revenue was down for seven of the nine publicly traded consumer merchants followed by Multichannel Merchant. And just two companies posted increased earnings.

According to Stuart Rose, managing director of Wellesley, MA-based investment bank Tully & Holland, the three companies with meaningful declines in earnings average 19.3%, led primarily by a 79% decline in earnings from general merchant J.C. Penney.

What’s more, the remaining six companies either went from profitability in the same quarter last year to a loss in the current period, or continued to lose money from the prior period. “The overall state of the multichannel retail segment is ugly, and has shown little signs of recovery,” Rose says.

Nasty net loss for Gaiam

Quarter ended: March 31 The facts: First-quarter sales for Gaiam, a manufacturer/marketer of healthy living products, decreased 14.2%, to $55.9 million from $65.2 million recorded in the same period last year. The company recorded a net loss of nearly $3.1 million, compared to net income of $2.2 million for the same period last year. “While actual net income showed a dramatic deterioration, it would have been even worse without a $2.2 million income tax benefit recorded in the quarter,” Rose explains. The skinny: Gaiam can’t seem to cut expenses in line with declining revenue, Rose says. “Gaiam needs to make dramatic changes to operations to bring earnings back in line.”

Pension expenses plague Penney

Quarter ended: May 2 The facts: First-quarter sales for J.C. Penney Co. decreased 5.9%, to $3.9 billion, down from $4.1 billion for the same period last year. Net income sank to $25 million, from a net income of $120 million last year. Same-store sales fell 7.5%. Improvements to gross margin and SG&A expenses indicate that J.C. Penney has reacted effectively to the economic downturn in cutting costs and improving efficiencies, Rose says. The skinny: The main factor driving the deterioration of the company’s bottom line is a large increase in pension expenses, Rose explains. “Removing pension plan expense/income from operating expenses shows that the company had a strong first quarter, given poor operating conditions.”

Jos. A Bank the big winner

Quarter ended: May 2 The facts: Jos. A. Bank Clothiers posted another solid quarter, with gains in both the top and bottom lines. The men’s apparel cataloger/retailer’s sales for the first quarter of fiscal 2009 rose 11%, to $161.9 million, up from $145.4 million for the period in 2008. What’s more, net income grew 17%, to $11.5 million, from $9.8 million. The skinny: Jos. A. Bank is no doubt benefiting from the poor economy, as the unemployed aim to upgrade their interview wardrobes to be more competitive.