We’ve seen the story before: Department store retailer excels in the ecommerce arena, department store retailer’s sales slip, Department store retailer’s CEO retires, New kid on the block takes over as department store retailer’s CEO, and…

Well, let’s just say it’s probably not possible that Jeff Gennette will sink Macy’s, Inc. like Ron Johnson did when he took over JCPenney. Although it should be noted that while Gennette will become CEO of Macy’s, Inc. in the first quarter of 2017, current CEO Terry Lundgren will remain on board as the retailer’s executive chairman.

Now, unlike Johnson, Gennette wasn’t hired away from another company to take the role of CEO. He’s been the president of Macy’s, Inc. for the past two years, and has served the company in some sort of executive capacity since 2006. But Gennette has been groomed as Lundgren’s heir apparent, which could mean it’ll be business-as-usual for Macy’s.

While the abrupt and uneducated changes Johnson made in JCPenneys’ merchandising and company culture were nearly its death knell, the current leadership team at Macy’s hasn’t been on a great run lately (despite its efforts to capture the fading department store shopper).

The Macy’s 2016 Fact Book shows that the merchant’s 2015 operating income fell from 10% in 2014 to 7.5% in 2015. So Macy’s is saving money and becoming a lot more profitable, but at what cost? Macy’s first-quarter 2016 comp sales fell a whopping 5.6% (and 7.4% overall). And that comes off a fourth-quarter (including holiday season) comp sales drop of 4.8% (5.5% overall).

“This is the time for us to be laser-focused on what is most important to our customers, and how we can best deliver the shopping experience that will secure our position as the premier omnichannel retailer of the future,” Gennette said in a press release to announce his promotion.

That’s all well an good, and Gennette went on to say that Macy’s will be a significantly different retailer in the future. But from my perspective as a customer, my perspective as the husband of a former Macy’s store-level employee, and as someone who not only reads the news but can cut through the clutter of a press release, there’s no

Here’s what Gennette needs to think about if he’s going to get Macy’s, Inc’s not just to regain its leadership position, but keep it from joining Gimbels, Montgomery Ward, Hills, and other prominent national department stores in the retail graveyard:

Treat Store Employees Right

During a session at Shoptalk last month, Macy’s senior vice president of strategy and innovation Michael Tobin joined Target.com president Jason Goldberger onstage to talk about the changing role of stores in ecommerce fulfillment. While Goldberger painted a picture of Target stores having happy, cohesive ship-from-store teams which took pride in making sure children had all their presents under the tree on Christmas morning, Tobin painted a different picture.

Tobin talked about how its strategy went from hiring a dedicated person in each of its stores to handle in-store fulfillment in 2013, to having its in-store operations team handle it as part of its day-to-day responsibilities in 2014, to just having a salesperson in each department handle it in 2015 didn’t make it sound like omnichannel at the store level was very important to Macy’s.

Or maybe that omnichannel is important, but its in-store employees don’t matter.

Earlier this month, about 5,000 Macy’s workers belonging to Retail, Wholesale and Department Store Union had demanded a more affordable health plan, pay increases and changes to scheduling and commissions policies.

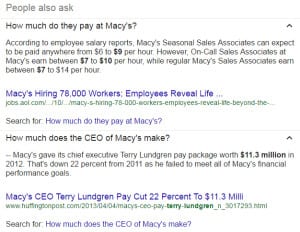

And Lundgren is also a strong proponent against raising the minimum wage, and says that the minimum wage increase in 2009 led to the loss of a half a million jobs (here’s some additional analysis). This image on the right – which you can click to enlarge – tells me that Macy’s does not pay its in-store hourly employees very well. And I can tell you just from observing Macy’s employees in action, and knowing my wife’s role as a former sales manager, the hourly employees are worked like dogs.

I’m not saying Macy’s has to pay its hourly employees enough to enjoy a country club lifestyle (BTW Lundgren takes home $11.3 million a year), but a livable wage will help create happier employees who are the face of your brand.

Hire More Store Employees

I think Macy’s is seeing the writing on the wall here. Its stores are horribly understaffed. Yes, employees are your number-one business expense, but if you have too few on the sales floor, it can lead to many customer service nightmares.

In its first-quarter earnings press release, Lundgren said the company is investing in front-line service such as more full-time store associates at Macy’s and Bloomingdale’s. This is great, because Macy’s had focused so much on ecommerce and omnichannel that it felt it didn’t need as many full-time sales associates on the floor. Yes, full-time employees are an investment on your bottom line, but they’re also much more invested in your business than someone who may get one or two shifts a week.

Stop Blaming Tourism for Lesser Net Sales

Macy’s plays the blame game when it doesn’t hit its sales goals. And this one is the regular kicker: “spending reductions by international visitors in major tourist markets where Macy’s and Bloomingdale’s are key destinations” (which it now says is double-digit for a second consecutive year).

I’m not sure how Macy’s tracks this, or how it determines international visitors in major tourist markets are hitting their stores. And I’m not sure where this would show up in the profit and loss statement.

But Macy’s has 99 problems and international visitors really ain’t one.

Create Private Label Brands People Want

I was talking at IRCE with Peter Sheldon, the Vice President of Strategy at Magento Commerce, about brands selling on ecommerce. And he agreed with me that one of the biggest reasons Sports Authority is going out of business is because millennials prefer to shop with brands, and not with merchants. So while you could buy Under Armour products at Sports Authority and at sportsauthority.com, the perception of millennial shoppers (and brand-centric shoppers) is that you can get more selection, better pricing, and a better experience if you buy direct from Under Armor.

Macy’s isn’t exactly selling private label merchandise that millennials are banging down the door to buy. Nor are the private label brands that they carry something customers of all ages are going to write home about.

But look at JCPenney and what it’s doing with its private label brands. Arizona, for example, is as much a lifestyle brand as it is a clothing label. And Kenmore, Diehard and Craftsman may be the three main reasons people shop at Sears.

Give the customer something they want to buy – something that is all your own, and the millennials will come.

Create Better Customer Experiences

Ship to store and in-store pick up drive customers to the store. But when they’re there to pick their purchase up, is Macy’s creating a memorable experience? Maybe in Herald Square and in other flagship stores. But in your everyday mall, not so much.

For a while, Macy’s was trying to upsell customers when they picked their purchase up. But if you don’t upsell the in-store pick up customer online, you’re not going to get them at the pick up desk. The customer may browse the store and buy additional merchandise, but most customers choose in-store pick up options for convenience sake. Get in, get out, bam.

Whether it’s online or in the store, Macy’s is not differentiating itself from JCPenney or from Sears or from Kohl’s or from Lord & Taylor or from Bloomingdale’s or from Saks. The signage may be different, but the general layout is the same.

Macy’s is showing some success with store-within-a-store. But why would I purchase something at the Lids Locker Room or Sunglass Hut within a Macy’s store when there’s a good chance that same merchandise is available in the main mall’s Lids Locker Room or Sunglass Hut?

But Macy’s needs to do a better job surprising and delighting its in-store customers. And that can start with the basics. Once Macy’s expands its full-time sales staff, and puts more salespeople on the floor. When there aren’t enough salespeople on the floor, the customer experience suffers.

Tim Parry is Multichannel Merchant’s Managing Editor, and the lead programmer for Growing Global.