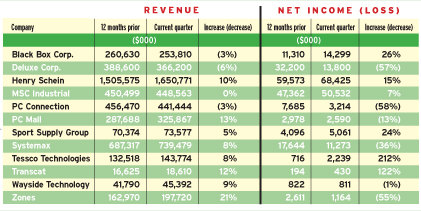

Despite The Ongoing Recession, the dozen business-to-business merchants and computer products marketers tracked by Multichannel Merchant turned in respectable — albeit not great — performances during the third quarter. All but four of the companies recorded year-over-year sales increases, while half of them received a boost in their bottom lines.

Of the 12 companies profiled, the average revenue growth was only 6%, notes Stuart Rose, managing director for Wellesley Hills, MA-based Tully & Holland, which tracks the publicly traded companies for Multichannel Merchant. “Since both industries tend to have a high correlation with the U.S. economy, the profiled companies have been negatively affected by the overall market as [gross domestic product] dropped one half of 1% in the third quarter.” With the economy tightening from a lack of investment, Rose expects the financial woes to continue.

Bottom-line drop at Zones

Quarter ended: Sept. 30 The facts: Although computer reseller Zones saw its sales rise 21%, to $197.7 million, its net income sank 55%, to $1.16 million, compared to $2.61 million for the same period in 2007. The company reported a gross margin of 10.2% for the quarter, a decrease from 11.2% last year. This is in part due to low-margin sales to major customers during the quarter and the general economy. The skinny: Chairman/CEO Firoz H. Lalji is leading a group to take Zones private at $7 a share — a readjusted price from $8.65. Regarding business performance, Rose says revenue grew due to an increase in the sales force and sales to two large customers. But the sales came at a lower gross profit.

Not so Deluxe quarter

Quarter ended: Sept. 30 The facts: Sales for Deluxe Corp., a marketer of personalized checks and other paper products, slipped 6%, to $366.2 million, from $388.6 million for the same period last year. What’s more, net income plunged 57%, to $13.8 million, from $32.2 million last year. Gross margin was 58.3% of company revenue, compared to 63.1% for the three-month period in 2007. The skinny: Deluxe saw lower volume due to its small business segment, which represents 58% of the company, Rose says. Revenue per order was down 4.7% and total orders were down 1.1% — although without including new acquisitions, its number of orders was down 4.7%.

Terrific quarter for Tessco

Quarter ended: Sept. 28 The facts: Tessco Technologies saw its fiscal second-quarter sales rise 8%, to $143.7 million, from $132.5 million last year. But the wireless communications mailer’s net income soared 212%, to $2.23 million, from $716,000 last year. The skinny: “Tessco saw a strong quarter as sales and gross profits increased across all lines,” Rose says. While Tessco warns that business may slow due to the economic crisis, “this quarter was terrific.”