In the midst of surging fuel surcharges and carrier rate increases, many online merchants are actively working to reduce shipping costs. Shipware recently conducted a national survey to identify the strategies shippers are using to drive down shipping costs and increase efficiencies.

This article addresses the top-five survey responses by ecommerce shippers when they were asked, “What steps have you taken over the past 12 months to reduce parcel costs?”

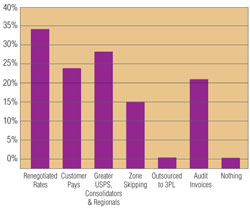

While survey responses varied by shipper size (package volume) and other factors, several common strategies emerged (see Figure 1).

Renegotiate Parcel Pricing Agreement

Of the ecommerce shippers surveyed, 36% named renegotiating pricing with their parcel carriers as the primary means to keep costs in check.

So how do you negotiate best-in-class parcel contracts with FedEx, UPS and other parcel carriers?

Before sitting down at the negotiating table, shippers should analyze service usage, expenditures, accessorial charges and other variables. The objective of this analysis is to develop a list of opportunities and priorities to be negotiated in order to generate the greatest cost savings.

Shippers should identify the impact of add-on fees for residential deliveries, extended areas, fuel surcharges, weekly service fees and other handling charges. There are more than 100 of these accessorial charges that make up to 30% of overall shipping costs. Quantify which surcharges have the greatest cost impact on your business and target those accessorial charges for waivers or reductions during negotiations.

Small changes to carrier agreements can have a large impact on overall savings. In addition to pursuing lower accessorial charges, of course, try for better overall discounts and contract terms.

If possible, conduct benchmarks to determine what range of discounting is possible and how your rates compare to other shippers of similar size. If you can’t benchmark internally, third-party consulting companies can conduct benchmark studies by industry and carrier, as well as by package volume.

Increase Use of USPS, Regional Carriers and Deferred Shipping Options

Thirty percent of ecommerce shippers surveyed have shifted some UPS and FedEx packages to less costly alternatives such as the U.S. Postal Service, regional carriers and postal consolidators—no surprise, since Priority Mail, First Class Parcel Service and other USPS products can cost up to 70% less than comparable services with FedEx and UPS.

Regional carriers, which serve specific regions within the U.S., are ideal for shippers with multiple distribution centers, especially if the DCs are aligned to the regionals’ delivery footprint. Regional carriers like Eastern Connection, Lone Star Overnight, On-Trac, Spee-Dee Delivery, Pitt Ohio and others offer reliable parcel delivery services at rates as much as 40% less than national carriers.

In addition to region-al and postal options, considder adding deferred, residential ground alternatives to your website; these may take a day or two longer—but at a fraction of the cost.

Parcel consolidators specialize in lightweight, low value, residential deliveries at rates often lower than USPS pricing. Other benefits include improved shipment visibility and less handling and damage.

Outdoor apparel and textiles manufacturer Woolrich significantly reduced its overall shipping costs by shifting the majority of its Ground residential shipments to deferred ground services using a postal consolidator. Conrad Schlesinger, Woolrich’s distribution manager, says almost 90% of its orders shifted from UPS Ground Residential to UPS Basic, and the only change Woolrich made was moving to the deferred ground alternative.

Companies that offer a parcel consolidation service include FedEx SmartPost, UPS (UPS Mail Innovations, UPS Basic and UPS SurePost), Streamlite, Blue Package Delivery, Newgistics, DHL Global Mail, Fairrington Transportation, Kaleidoscope Services, OSM Worldwide, ParcelPool and SP Express.

Each leverages USPS Parcel Select services and workshare discounts. Consolidators handle pickup, sortation, transportation and induction to the USPS hub. USPS handles the “final mile” delivery. The deeper the induction to the USPS, the greater the workshare discounts enjoyed by the consolidator and, in turn, the greater the cost savings available to shippers.

While the goods being purchased often dictate the shipping method (frozen steaks on dry ice must be shipped for delivery within two days, for example), presented with a choice, many online shoppers will choose the low cost (or free) delivery option even if it means a longer transit.

Pass Along Shipping Costs to the Customer

Passing along shipping charges to customers is a method of controlling costs used by 26% of the survey respondents. However, charging back all costs associated with each shipment can be challenging, since as much as 20% to 25% of total shipping charges are tacked on long after a shipment has been manifested. These backend charges appear on carrier invoices as separate charges often weeks after the original shipment was charged. These include:

• FedEx and UPS charges like Address Correction fees ($11 Air/Ground, $50 Freight)

• Residential surcharges ($2.55 Ground, $3 Express)

• Additional Handling Service ($8.50)

• Large Package Surcharges ($55)

• Delivery Area Surcharges ($2 commercial DAS, $3 residential DAS)

• Invalid Account Number ($11)

• Dimensional adjustments, duties and taxes, and additional fuel surcharges

Many ecommerce companies assess a “handling fee” in an effort to account for some of these backend charges.

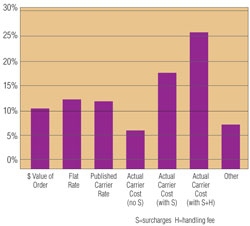

How do shippers charge back shipping costs? Results from a 2008 Parcel survey (Figure 2) revealed that 46% charge back actual carrier costs, including surcharges, with 59% of that group including a handling fee (27% of all survey respondents). Other common charge-back methods include flat shipping rates for all orders (13.5%), basing the shipping charges on the order value (11.5%), and charging the customer at the carrier’s published (undiscounted) rates (13%).

Audit Freight Invoices

Twenty-three percent of survey respondents have increased their efforts to recover some costs by auditing their weekly carrier invoices. Each year, more than $3 billion in guaranteed service claims are not refunded because claims are never filed. Shippers that take the time to audit invoices can tap into this often overlooked source of cost savings.

In addition to late shipments entitled to money-back guarantees, shippers should audit for missing discounts, overcharges, shipments manifested but never shipped, and other erroneous charges common with parcel invoices.

Companies unable to audit internally might consider outsourcing to audit firms that specialize in parcel spend management. A qualified freight audit firm can produce weekly savings between 1% and 15% of the total weekly parcel invoice.

Incorporate Zone Skipping and Drop Shipping

Zone skipping as a strategy to reduce costs and improve delivery times was employed by 17% of survey respondents. Zone skipping, or zone jumping, is usually an option for volume shippers and involves bypassing parts of the initial transportation segment by dropping off packages closer to the final destination within a carrier network.

Bakers Footwear, a retailer of shoes and accessories based in St. Louis, successfully zone skips the majority of its store-bound merchandise. According to Charlie Kantz, vice president of distribution, Bakers Footwear saves an average of $2 per carton by zone jumping. The retailer hired logistics consulting firm Lighthouse Consulting to analyze cost savings opportunities, and learned that by line hauling orders directly into three strategic FedEx Ground hubs in Barrington, NJ, Atlanta and St. Louis, Bakers could avoid incurring higher costs that would otherwise be considered Zones 6-8. By zone jumping, Kantz says, approximately 80% of Bakers’ freight is rated as Zone 2-3, with no loss in transit days.

Another operational strategy to reduce logistics costs is to drop ship orders from vendor locations. AutoAnything, a San Diego-based online retailer of specialized automotive products, manages to control logistics costs in part through an extensive vendor drop ship strategy. David Klein, AutoAnything co-president, says its drop ship business model virtually eliminates the need for warehousing and inventory management.

Of course, there are dozens of other strategies, services and technologies that can help you contain or reduce costs. However, the strategies discussed should point you in the right direction and make you more competitive in your market.

Rob Martinez is president and CEO of transportation spend management firm Shipware.