Many business owners were in for a shock when they received their January invoices from FedEx and UPS. That’s because they were finally able to see the impact of dimensional weight pricing firsthand.

In case you’re just now hearing about these changes, dimensional weight pricing is a method of calculating shipping costs based on the volume of a package — or the amount of space it occupies — in relation to its weight. FedEx and UPS began applying this pricing method to all Ground shipments in 2015. The result is a substantial price hike for larger, lightweight packages that can have a big impact on your business’ bottom line.

Lately, I talked about dimensional weight pricing and offered some potential solutions for businesses. Today, I’d like to take a closer look at why FedEx and UPS are using this type of pricing for domestic ground shipments and provide some fresh insights from business owners on how they’ll be affected.

Ecommerce Growth Sparks New Pricing Model

A number of factors and trends have led to the transformation of the domestic package delivery market, but none greater than the growth of ecommerce.

As ecommerce continues to account for a greater chunk of retail sales, there has been a corresponding rise in items being shipped via ground instead of air. In fact, according to a white paper by The Colography Group and Endicia, the lion’s share of the 70% growth in total air and ground parcels has been in ground.

Additionally, more items are being shipped B2C, which translates into fewer packages delivered per stop, making residential deliveries a cost-intensive activity for FedEx and UPS. UPS reported that it has seen its home deliveries rise from 20% to 44% over the past 10 years.

Finally, the average weight of individual packages has declined. Rather than sending one 50 lb. box filled with multiple items; it’s common for shippers to send 25 2 lb. boxes with fewer items. Not only do these packages usually weigh less, they also take up more room on a truck than one large shipment would. This inefficient utilization of space equals a hike in the cost per package.

By changing the way they price packages, FedEx and UPS can increase revenue that has been lost because of these trends.

Businesses Weigh In on Pricing

We were interested asking business owners what they think about the new pricing, how they’ll be impacted and what they plan to do.

This past December, Endicia surveyed more than 700 business owners and customers on dimensional weight pricing. Despite the reasons for the rate changes, businesses see one thing — red ink.

Here’s what businesses had to say:

- 74% disagree with the rating method, because they believe it is expensive and unfair

- 28% of businesses hadn’t heard of dimensional weight pricing

- 70% say their businesses will be impacted

- 57% believe more than a quarter of their total package volume will be effected

- 80% say they will use the U.S. Postal Service for their larger, lightweight packages

The USPS did not increase shipping costs in January 2015. In fact, it reduced its Priority Mail rates in September 2014, making it an affordable option for businesses to ship packages weighing up to 40 lbs.

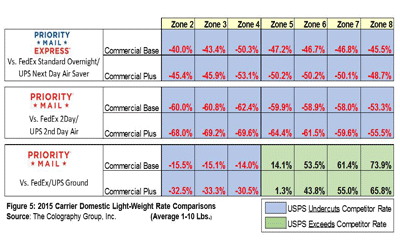

It should be noted that the USPS does have dimensional weight pricing; however, it does not apply to packages smaller than 1 cubic foot. This Colography Group chart outlines where Priority Mail beats pricing from FedEx and UPS. As you will notice, USPS beats the competition in 80% of the cases.

When it comes to dimensional weight pricing, businesses can only do so much. They can accept the new rates and adjust prices elsewhere to recoup some of the costs; or reduce packaging by using less packing material, like bubble wrap (which is not always a possibility). Or, like many of the respondents in the survey, they can explore alternative carriers like the USPS.

Whatever you choose to do, it’s important to keep in mind that this trend will likely result in further changes in how carriers set pricing parameters. Businesses need to be prepared to meet the next challenge head on by remaining informed, nimble and innovative.

Amine Khechfé is co-founder and general manager of Endicia.