Is your shipping a cost or profit center? We asked several hundred shippers in a recent survey and reached several important conclusions.

For starters, 51% of companies reported that shipping is a profit center. Let’s call this half Group 1, while the 49% that either did not know or reported shipping is a cost center will be Group 2.

By analyzing the survey responses, we identified both tactical as well as strategic differences between these two groups. Group 1 shippers generally know much more about their distribution than Group 2. For example, 77% of Group 1 shippers could specifically quantify shipping costs as a percentage of cost of goods sold (COGS) vs. only 63% of Group 2.

One difference between the two groups is charge-back policy: 91% of Group 1 mailers charge back shipping costs, whereas only 52% of Group 2 companies do so. When asked how they dealt with higher shipping costs, more Group 1 companies (37%) said they pass along cost increases to their customers than Group 2 firms (25%).

Review and adjust

Group 1 companies review and adjust their shipping charges much more frequently than Group 2. Forty-one percent of Group 1 companies adjust rates every one to three months (26% for Group 2). In fact, 95% of Group 1 businesses adjust rates every one to 12 months; 59% of Group 2 firms adjust rates annually or longer.

When should you adjust shipping rates? With fuel surcharges changing monthly, you should review them at least every 30 days. One way to ensure adequate profitability of shipping orders is to use software to look up your discounted rates in real-time and automatically assign a markup.

The carriers offer application programming interface (API) software that allows you or your customers to access designated rate tables in real-time, generally when your customer is about to finalize an online order.

One of our clients created a table that not only includes its discounted rates plus a 10% markup, but also residential fees, delivery area surcharges and fuel surcharges on every shipment. This doesn’t always ensure that the client captures 100% of its costs on every single shipment, but based on historical averages, shipping creates profits of 20%.

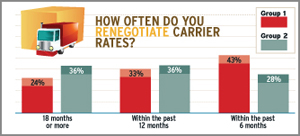

A dramatic difference between Group 1 and Group 2 is how often the companies renegotiate carrier rates. Forty-three percent of Group 1 companies negotiate at least every six months, vs. only 28% of Group 2.

While you should take a long-term approach to partnering with your carriers, you may not be taking advantage of current market conditions and pricing. In today’s economy, your carrier may be willing to give you incentives and concessions that were not previously available.

One challenge in making shipping a profit center is that numerous charges are tacked on after a shipment is manifested. These include common accessorial charges like address correction ($6 Ground, $10 Express, $50 Freight), residential surcharges ($2.05 Ground, $2.40 Express), additional handling service ($7.50), large package surcharges ($45), over maximum limit ($50), delivery area surcharges ($1.60 Commercial, $2.40 Residential, $7.50 Hundredweight), invalid account number or refusal ($10), dimensional adjustments, duties and taxes, and additional fuel surcharges.

We estimate that 25% to 35% of total shipping charges are applied on the back end. These supplemental charges are often invoiced separately from the original freight charges, and matching the two prior to customer charge-back is challenging — if not impossible.

Still, Group 1 companies try to recover both freight charges as well as supplemental charges. And they also assess an additional “handling fee” to account for unaccounted-for discrepancies (34% of Group 1 companies do this vs. 20% of Group 2 firms).

To ensure you charge back total costs, work with your carriers to install solutions to capture as many upfront charges as possible. For example, to capture delivery area surcharges (DAS) at shipment origin, use third-party or carrier manifesting systems that recognize DAS ZIP Codes and include charges as the shipment is processed.

Also consider address validation software to reduce address correction fees. Apart from avoiding fees of $6 to $50, there are many additional benefits, including fewer reships and returns and, most important, a better customer experience by getting the original shipment delivered on time.

Similarly, residential delivery indicator (RDI) software can help you properly classify residential and commercial addresses to avoid backend charges on your carrier invoice. Many companies offer address validation and RDI software. Before purchasing, be sure to talk to your carrier rep as they may provide similar tools free of charge.

Another way to avoid supplemental charges: Use prepaid or flat rated products. Both allow you to buy domestic and international express services in advance at a preferred rate. Since you’ve already paid a set rate, you could avoid backend fees like residential, DAS and other surcharges.

Moreover, you can potentially reduce costs by shipping heavier items that normally would be rated on a per- pound basis. You can mark up the rate to ensure a profitable shipping transaction. Again, consult with your sales rep, as each carrier offers slightly different products.

Group 2 companies tend to ship more to residences (54%) than Group 1 (38%). Residential shipments not only get additional surcharges, but discounts are often less for residential than commercial delivery.

That’s why residential shippers should negotiate accessorial concessions and deep incentives with their carriers. They might also consider using USPS Priority Mail, First-Class Parcels and Parcel Select services over costly private carrier Express and Ground services.

Scrutinize your invoices

Review your carrier invoices for dimensional charges and carrier reweighs. If you find you’re being hit with these additional fees, consider investing in accurate scales and cubing equipment so you can precisely determine the billed weight of the shipment.

If you’re a UPS shipper, ask your rep about “scan-based billing.” With scan-based billing, an invoice is not generated until the shipment has been delivered, rather than when a shipment is manifested. By then, most if not all supplemental charges have been identified.

Returns offer another point of separation between Group 1 and Group 2. Group 1 shippers are twice as likely to charge a combination of actual carrier costs, including surcharges and a handling fee (16% vs. 8%).

Group 1 companies are also more than twice as likely to charge published (undiscounted) carrier rates for returns (12% vs. 5%). Forty percent of Group 2 companies, on the other hand, do not charge anything for returns, vs. 31% of Group 1 companies.

And more Group 1 firms offer their customers a choice in shipping methods and carriers (86% vs. only 68% for Group 2). This may seem counterintuitive, since a common cost control strategy is to dictate carrier and mode.

But we’ve concluded that this has more to do with Group 1 companies using best practices rather than a means to generate profits on shipping: Research shows that the majority of consumers and businesses want to choose their delivery company. l

Rob Martinez ([email protected]) is a partner at Navigo Consulting Group, which provides contract benchmarking, distribution analysis and carrier negotiations.