New York and Berlin, Jan. 26, 2022 – Leading ecommerce delivery experience platform Parcel Perform has unveiled new logistics insights based on parcel tracking volumes around 2021’s peak ecommerce season for the United States and Europe. The findings indicate and reinforce an industry-wide consensus of the decline in the luster and appeal of Black Friday and Cyber Monday (BFCM) ecommerce events among consumers.

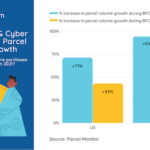

Based on the data generated from Parcel Perform’s community and insights platform, Parcel Monitor, parcel volumes in the United States grew by 43% compared to pre-BFCM levels, falling short of 2020’s volumes at 71%. In Europe, there was 70% parcel volume growth in 2021, a significant dip from 94% experienced in 2020. The decline was even more noticeable in the United Kingdom, where parcel volumes decreased from 98% during BFCM 2020 to 45% during BFCM 2021. A similar trend was also seen in Germany, from 90% in 2020 to 79% in 2021.

This trend follows predictions in early November 2021 that EU and US consumers would shop earlier for the holidays and would not choose to wait for the BFCM sales. Similarly, the findings also align with Adobe’s analysis, which pointed to a 1.4% decline in U.S. ecommerce spending during the festive shopping period.

Parcel transit times appeared to have improved year on year with only a slight delay during BFCM 2021, with US merchants having shown a greater improvement than their EU counterparts in handling parcel surges. There was a 23% delay in delivery times in 2020; that number decreased to 13% in 2021. In Europe, transit times improved year-on-year with only a slight impediment during the peak season with a delay in 10% delivery times for 2021 compared to 2020 at 9%.

“Insights into our data between pre-BFCM and BFCM parcel volumes reveal the ongoing shift in online consumer attitudes towards festive shopping,” said Dana von der Heide, Co-Founder and Chief Commercial Officer at Parcel Perform. “Despite global supply chains grappling with pent-up demand for consumer goods, the improvement in transit times was indicative of consolidated efforts of many carriers being better prepared for potential peak season surges in parcel deliveries.

“Global ecommerce sales are projected to reach an estimated US$5 trillion in 2022, and consumers are getting better at anticipating and identifying opportunities for online savings and deals beyond yearly peak periods. At Parcel Perform, we expect ecommerce parcel volumes to grow significantly in 2022. We are committed to helping our merchant partners and carriers optimize their parcel delivery services to meet the growing demand for end-to-end fulfillment.”

“Parcel carrier delivery performance appeared to have collectively improved significantly in 2021 over 2020,” said Nate Skiver, Founder of LPF Spend Management. “I believe the combination of carriers’ network expansion and staffing efforts, package volume being more spread out over the Q4 period, and larger retail shippers diversifying their carrier base all contributed to the improved delivery performance.”

“The decline for Black Friday and Cyber Monday doesn’t come as a surprise,” said Wolfgang Lehmacher, Former Head of Supply Chain and Transport at the World Economic Forum. “2020 was an exceptional year for ecommerce, with digital adoption serving as a silver lining to the pandemic. In 2021, consumers yearned to return to the physical retail experience, which saw a shift in spending patterns during the festive peak period. We will see more innovations in 2022 that will continue to blur the lines between ecommerce and retail. I’m confident that the sector will maintain its strong growth in 2022, possibly surpassing 2020 and 2021 collectively.

Utilizing Parcel Perform’s proprietary machine learning technology, Parcel Monitor’s research team analyzed more than one billion anonymized data points from 130+ countries each year through our benchmarking and carrier performance measurement activities. High-quality data from millions of parcels tracked from more than 700+ carriers have been analyzed to create these findings. In addition, Parcel Monitor’s analysts compared the parcel volume growth and transit time between three weeks before Black Friday Cyber Monday and three weeks after Black Friday Cyber Monday.