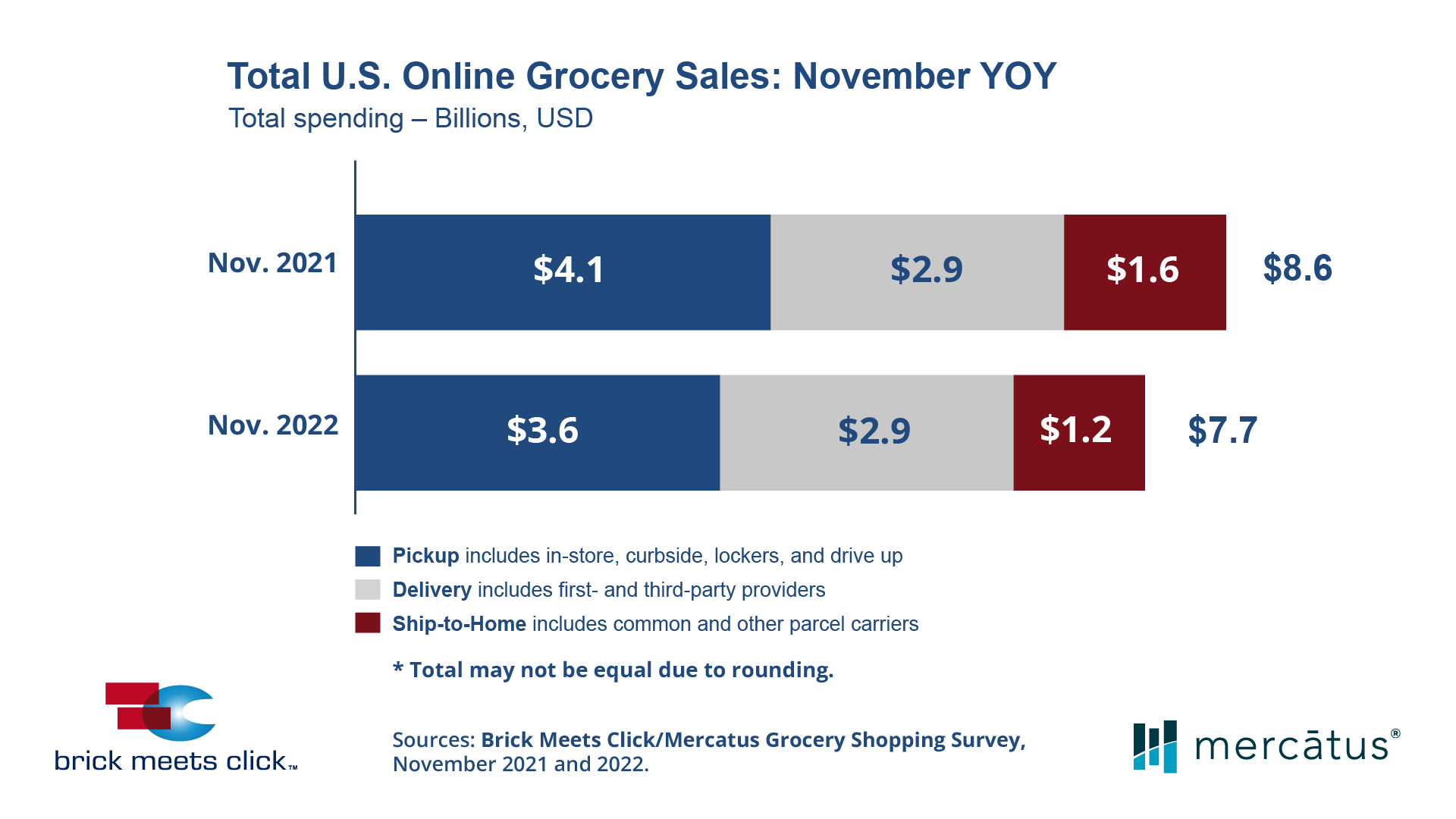

Domestic e-grocery sales continued on a downward trajectory from pandemic-fueled highs, decreasing 10% year-over-year in November to $7.7 billion, down slightly from $7.8 the two prior months, according to the latest data from Brick Meets Click and Mercatus.

Meanwhile, overall grocery sales rose 7.95% in October, holding strong in the face of inflation that was still running at 7.1% as of November, down from 7.75% in October, according to figures from the U.S. Census Bureau.

The year-over-year drop in e-grocery sales was driven by fewer households buying online, combined with lower order frequency and smaller basket sizes among monthly active users, the companies reported. However, the volume of e-grocery deliveries remained consistent from 2021.

Brick Meets Click conducted the survey of 1,749 adults on Nov. 29-30.

Total households ordering groceries online was down 7% in November. The companies said this was due to a big drop in the 60-and-older age group, as well as a sizable decline in the core 30–44-year-old bracket. Monthly average users were down 5% compared to November 2021.

Among monthly active users using pickup or delivery services, cost was cited as the most important factor in where to shop by 42% of respondents, up from 37% when the question was first fielded by Brick Meets Click in August 2020. This slight increase is surprising, given the level of overall inflation this year and the consumer anxiety it has engendered, even though spiking costs have fallen from a high in the summer.

Monthly online users purchasing from mass market retailers have remained consistent in terms of those citing cost as the main decision factor, at 45% for the past two years, while the percentage of overall grocery customers calling out prices rose from 25% in August 2020 to 38% last month.

“When it comes to shopping online, especially for delivery or pickup, cost considerations include more than the price paid for a basket of products,” said David Bishop, a partner at Brick Meets Click, in a release. “Many customers also evaluate the total cost associated with using the service, which can include special charges, standard fees and tips.”

A new survey from Havas Media Group and customer experience intelligence firm Disqo found brands tapping social advertising in grocery and CPG saw the greatest conversion lift relative to other channels in metrics for ad awareness (7x), followed by brand ecommerce (3.5x), category site visitation (2.3x) and category search (2x).

“As such, social media advertising is helping consumables advertisers push memorable campaigns that are driving consumers directly to the bottom of the purchase funnel, where they are executing more brand-specific product purchases,” the companies said in their analysis.