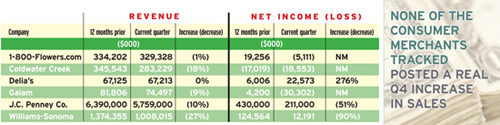

Even If Flat is the New Up, only one of the publicly traded business-to-consumer merchants tracked by Multichannel Merchant was “up” for the fourth quarter. Revenue was down an average 10% over last year.

“Financial results across the board were indicative of an already weak consumer spending environment, which further deteriorated in the fourth quarter, as consumer spending was down over 4%,” says Stuart Rose, managing director of Wellesley, MA-based investment bank Tully & Holland, which tracks the companies for Multichannel Merchant.

Coldwater Creek and Williams-Sonoma experienced the largest declines in revenue. “Low sales this quarter, for the most part, were overwhelmingly coupled with even worse profits,” Rose explains. While half of the consumer businesses sampled reported positive profits, two of them — J.C. Penney and Williams-Sonoma — also recorded significant declines in profits.

J.C. Penney’s profits cut in half

Quarter ended: Jan. 31 The facts: Fourth-quarter sales for Plano, TX-based J.C. Penney Co. decreased nearly 10%, to $5.75 billion, compared to $6.39 billion last year. Same-store sales slipped 10.8% for the period ended Jan. 31, 2009. Net income shrank nearly 51%, to $211 million, down from $430 million in the fourth quarter last year. For fiscal 2009, the general merchant plans to cut capital spending by opening fewer stores and slowing inventory growth and other expenses. It plans to accelerate the opening of its better performing in-store Sephora beauty boutiques. The company has also launched new product lines with designers Ralph Lauren, Allen Schwartz and Charlotte Ronson. The skinny: Overall, Rose says, J.C. Penney is well positioned to weather the downturn with its strong balance sheet, innovative and differentiated product line, and cash management initiatives.

Net income falls 90% at Williams-Sonoma

Quarter ended: Dec. 31 The facts: Williams-Sonoma’s fourth-quarter revenue decreased 26.7%, to $1.008 billion, compared to $1.374 billion in the fourth quarter of 2007. Net income plunged 90%, to $12.19 million, from $124.56 million in the quarter for 2007. Topline pressure, along with poor margins due to increased promotional spending, affected its net income, Rose says. Fourth-quarter revenue in the company’s direct-to-customer segment fell 30.5%, to $367 million, from $528 million in Q4 07. Internet revenue decreased 27.1%, to $269 million. The skinny: Although the management has announced impressive cost cutting measures, such as an 18% reduction in headcount, reducing inventories and shrinking infrastructure, Rose says the grim sales outlook will continue to erode profits.

Huge net income swing for Delia’s

Quarter ended: Jan. 31 The facts: Fourth-quarter sales at cataloger/retailer Delia’s were nearly flat at $67.2 million. But for the 13-week period, net income jumped 276%, to $22.6 million, up from $6.0 million. Same-store sales increased 2%. Total retail sales increased 6.9%, to $33.9 million. Sales for the direct segment, which includes the Delia’s and Alloy teen girls’ apparel catalogs, fell 6%, to $33.3 million. In September, Delia’s sold its extreme-sports gear merchant CCS to retailer Foot Locker for $102 million cash. The skinny: Delia’s did a massive repositioning of brand strategy in the third quarter in shedding CCS, which helped boost sales this quarter, Rose says.