For the Second Time in Less than a Year, Spiegel Brands has a New Owner. Signature Styles, a newly formed division of private equity firm Patriarch Partners, acquired the multititle apparel cataloger on June 17 from Granite Creek Partners for an undisclosed price.

Granite Creek Partners had purchased Spiegel Brands in September 2008 from Catalog Holdings, a portfolio company of Golden Gate Capital that had owned Spiegel since 2004.

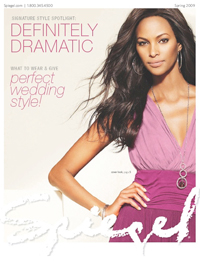

The deal affects the Spiegel, Newport News and Shape FX catalogs and Websites, as well as the A.B. Lambdin and Carabella brands, which were merged with the Spiegel and Newport News properties during Granite Creek Partners’ ownership.

Patriarch Partners purchased Spiegel Brands for its Web presence, “and we’re pretty much leaders in that in the direct-to-consumer world,” says Spiegel Brands president/CEO Geralynn Madonna. Furthermore, Spiegel Brands offers a strong value proposition, Madonna says. “It’s really the power of the brand.”

Not only is Spiegel a strong brand, says Patriarch spokesperson Taylor Griffin, it provides “an excellent direct-to-consumer channel for Patriarch’s other consumer products companies.”

A HOT POTATO

Still, the fact that Spiegel Brands has changed hands three times in five years raises some questions about the health of the business. Some investment analysts speculate that the company proved to be harder to fix than the new owners thought.

Lee Helman, managing director with investment firm Financo, believes Spiegel ran into trouble after it was sold by Golden Gate. “It was either a capital structure that didn’t work and/or a challenging business that might not have performed as planned,” he says.

Helman also thinks a “shrinking open-to-buy” offered by the credit processor was an issue: Given the tight credit markets, “the third party that manages its proprietary credit cards was probably giving less credit to each cardholder.”

These factors, Helman adds, might have made the partnership that Madonna had with Granite Creek challenging, “and the business needed new capital and owners.”