This month, FedEx Express installed four robotic arms inside a sortation hub in its hometown of Memphis, in response to demands placed on its services in the midst of the massive pandemic-influenced surge in ecommerce orders, and to help distance workers.

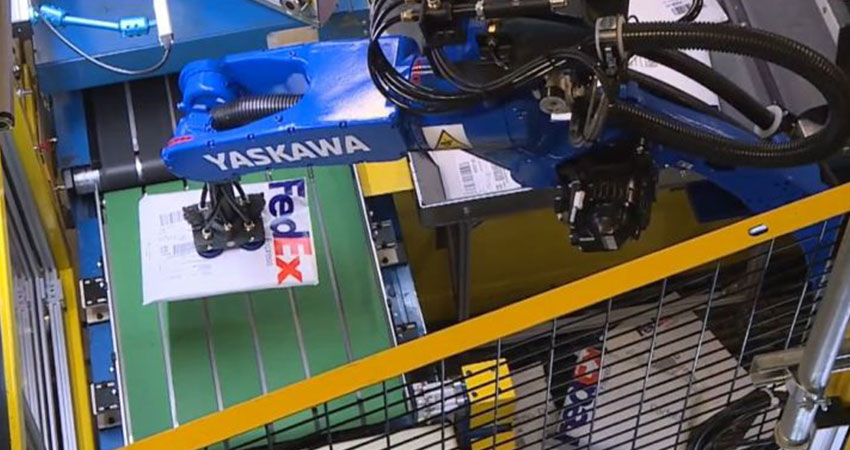

FedEx teamed up with robotics companies Yaskawa America, which supplies the robotic arms, and Plus One, provider of the software system. The arms are handling the repetitive process of sorting small packages and letters within the Express network, transferring them from bins to conveyors to be scanned and inducted into the Small Package Sort System (SPSS) at the Memphis hub.

FedEx, UPS, DHL and many other logistics and delivery firms have been hiring hundreds of thousands of workers since March to handle the peak season-like growth in packages being handled in their networks. First UPS in late May and shortly after FedEx in early June added surge pricing, normally reserved for peak, to offset their increased costs.

As with every other distribution and fulfillment facility operator, carriers have to observe new restrictions on worker spacing and contact. The robotic arms will help FedEx to lessen associate contact while each does the work of three humans.

Robotics and automation solutions are seeing a great deal of interest and investment during the recent ecommerce boom, where studies have shown online ordering has ballooned up to 27% of all retail, from about 12% prior.

According to a study by Honeywell released earlier this month, 98% of fulfillment executives surveyed at ecommerce companies said they are investing in automation to a significant extent, but 88% said they’re having a hard time implementing and scaling robotic systems. KRC Research conducted the survey of 434 U.S.-based fulfillment executives in April and May.

This compared to only 35% of executives from retail companies who said they are making significant investments in automation, the lowest of seen industries surveyed.

The industries most willing to invest in automation, according to the survey, were ecommerce (66% of respondents); grocery, food and beverage (59%) and logistics (55%).

Warehouse execution software (cited by 48% of respondents), order picking technology (46%) and robotic solutions (44%) led the list of technologies receiving investment, Honeywell found. The company’s Intelligrated division, which it acquired in 2016 for $1.5 billion, makes material handling automation software and hardware systems.