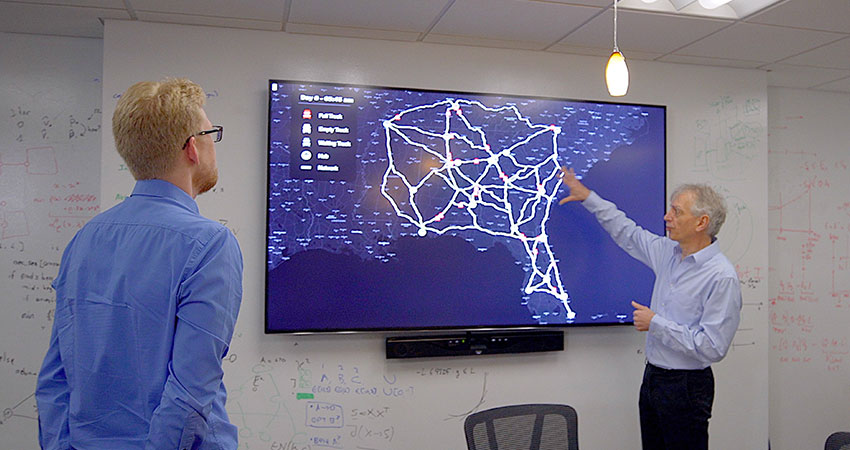

Georgia Tech Prof. Pascal Van Hentenryck examines the Ryder network used in the study (credit: Business Wire)

A study by Georgia Tech commissioned by Ryder found that a regional autonomous middle mile hub network, based on data from Ryder’s dedicated transportation network in the Southeast, could reduce costs between 29% and 40%.

The team from Georgia Tech’s H. Milton Stewart School of Industrial and Systems Engineering (ISyE) modeled an Autonomous Transfer Hub Network (ATHN) for the region, based on Ryder data, combining autonomous trucks on dedicated middle mile routes with conventional trucks in the first and last miles.

Using optimization models for routing and dispatching, and evaluating the ATHN by comparing it with existing operations under various assumptions, the researchers came up with the savings range. Results depend on the cost of the autonomous trucks themselves as well as direct and indirect operating costs, according to the study.

Mike Plasencia, Ryder’s executive director of innovation, said savings are based on the various efficiencies gained by introducing autonomous vehicles into the middle mile network. For instance, the autonomous trucks have greater fuel efficiency, lower operating costs and greater network opportunities. He said the model shows how empty miles on backhaul runs are reduced because the trucks are in service longer and can wait as long as need be for a profitable return load while drivers’ on-the-road hours are limited.

“For example, there might be a great backhaul for the next load that’s 200 miles away,” Plascencia said. “That’s 200 miles of driver and fuel costs. With an autonomous truck, you just pay for fuel, and you’re not wasting driver hours. Now you can capture more freight you haven’t captured before.”

He also said a revamped network with autonomous trucks will require more flexibility on the part of shippers in terms of receiving schedules, in order to optimize potential efficiency.

“The study found that as you increase the flexibility of appointment times, it opens the door to more savings and reduces empty miles,” he said. “To take full advantage of the value autonomous vehicles bring through the network, shippers need to adapt their receiving schedules to accommodate it.”

He said the transfer hubs would be a place for autonomous trucks to have their loads transferred onto driver-operated vehicles for final delivery. They would also function as maintenance facilities, where the autonomous trucks could be inspected and, if necessary, have sensors and systems recalibrated before the next run to drive uptime and vehicle utilization.

Introducing the autonomous trucks into the network also requires a reconfiguration of dispatching and other systems, including technology investments, to efficiently coordinate the movement of vehicles and goods across modes.

Pascal Van Hentenryck, associate chair for innovation and entrepreneurship at ISyE, said his team will continue to work with Ryder, including looking beyond dedicated transportation to other areas where efficiencies can be gained by adding autonomous trucks, including at the loading dock, as well as expanding the study out across the entire U.S.

“It’s a really good first step to put more autonomous vehicles on the road, but looking at the infrastructure needed to facilitate autonomy is critical,” Van Hentenryck said. “And it’s easier for the public to accept having cars and trucks with drivers vs. autonomous vehicles servicing the first and last miles. Starting with the middle mile is a safer, more controlled environment.”

Last month, Ryder announced an investment in Gatik, whose technology will power autonomous middle mile deliveries for retail and ecommerce clients in the Dallas-Fort Worth area, initially using 20 leased Ryder box trucks for the purpose.