Point Pickup, a provider of last-mile services for grocers, general merchandise and oversize goods, has acquired ecommerce platform GrocerKey, providing an end-to-end solution for retailers looking to own the customer experience and data often missing from third-party solutions like Instacart.

Instacart, with its massive growth in recent years, has become like another two-edged sword a la Amazon in the grocery space, providing retailers with the opportunity to drive a lot of new business while also creating a distance from their end customers. The same can be said of 3P platforms right behind it like Shipt, DoorDash, Gopuff and FreshDirect.

“Our mission from day one when we founded the company in 2015 was to save retail America from Amazon or whoever else comes along and takes their customers from them,” said Point Pickup founder and CEO Tom Fiorita. “We set out to build a platform that allows every retailer, grocery or not, to own their brand, customer, data, revenue stream and everything that goes along with it. We consider ourselves an enablement platform.”

About 60% of Point Pickup’s business comes from grocery, Fiorita said, with the balance from general merchandise, pharmacies, alcohol and oversized/bulky goods. “That percentage will continue to fall, with the growth in general merchandise and other categories, and the mix will come closer to parity,” he said.

Point Pickup, which counts major grocers including Walmart, Kroger, Albertsons and Giant Eagle as customers, has access to a network of 350,000 independent drivers in 25,000 ZIP codes in all 50 states. Fiorita said as the acquisition just closed a week ago, he could not say which majors plan to use his company’s full suite of ecommerce and fulfillment services, adding there is a great deal of interest.

Some mid-market grocers like Woodman’s and Fairway are already testing out the end-to-end service, he said.

“I’m a market listener, and all the majors asked me if we could add on services so they could own their brands and customers,” Fiorita said. “I feel very comfortable we’ll see even larger adopters.”

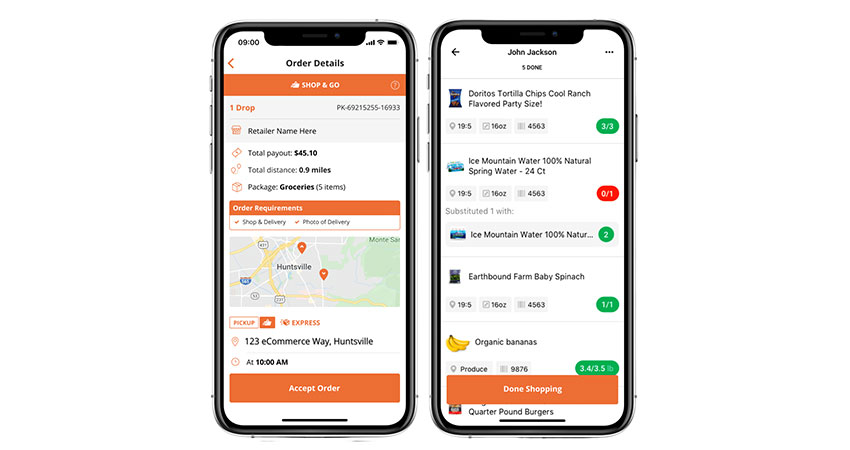

With the addition of GrocerKey, Point Pickup provides everything from pick and pack to last-mile delivery in a modular package that plugs into existing ecommerce platforms. Its technology matches the nearest available driver for each order, with 95% of the U.S. population within five miles of one of them to enable same-day delivery. Like Shipt and Instacart, Point Pickup offers the option of personal shoppers as well as delivery. Retailers can also analyze customer data and use the insights to drive sales through merchandising and promotions.

Fiorita said while some retailers his company works with will opt to keep driving business through third-party platforms, many more are looking to own more of the customer data and experience. He likened it to the travel industry, where discount marketplaces like Travelocity, Trivago and Booking.com have become popular, but airlines and hotels aren’t the biggest fans even though it’s a solid stream for them.

“Ten years ago, I used Travelocity and Expedia,” he said. “Then all the (travel) companies realized the digital age overcame them, and they needed to know consumers’ travel habits. Expedia drive sales to Delta, but Delta would rather you go to them directly for upsell and discounts. But the biggest difference is, Expedia is not becoming an airline, but Instacart and others like it are already becoming retailers.”