Amazon once again claimed that the latest Prime Day event was the biggest ever, with 300 million items sold and importantly, more than $1.7 billion saved by shoppers, as some observers had said ahead of the fact that deals weren’t all that spectacular compared to everyday offerings.

Interestingly, for the first time in recent years, Walmart did not trumpet a competing event to Prime Day, as did others like Best Buy and Target, with many looking to offload excess inventory. But the largest retailer did run some steep discounts of its own on a raft of popular consumer electronics.

The biggest sellers over the two days, according to Amazon, were Apple Watch Series 7; diapers and wipes from Pampers and The Honest Company; kitchen essentials from Rachael Ray, Le Creuset, and Hamilton Beach; and Levi’s apparel and accessories. Also, of course Fire TV, Echo and Blink devices. Amazon said Prime members in the U.S. purchased 60,000 items per minute over the two days, and over 100,000 per minute worldwide.

With livestream shopping yet to catch on in the U.S. in a big way, compared to China where it’s a $400 billion phenomenon, Amazon touted the fact that Amazon Live streams had more than 100 million views of streams from thousands of creators. How much of that converted to sales is unknown.

According to data from Adobe, total U.S. online spend in the 48 hours of Prime Day was $11.9 billion ($6 billion on Tuesday, $5.9 billion on Wednesday), up 8.5% from 2021’s $11 billion. Adobe found the strongest discounting Amazon during Prime Day to be toys, followed by apparel, electronics, TVs and computers. The average online revenue lift across the U.S. was 141%, compared to an average June day.

While the increase bested a 6.1% bump in 2021, per Adobe data, it was significantly below gains of 64% in 2019 and 54% in 2018, and Amazon was looking for a home run to pivot from some recent bad news.

“With the second Prime Day also seeing strong gains, retailers were able to generate approximately $12 billion dollars in online spend,” said Pat Brown, vice president at Adobe. “And with back to school around the corner and promotional discounts being quite favorable for consumers, we saw accelerated growth momentum for days that have historically produced significant spending.”

At least in Manhattan, building concierges were getting creative to deal with the deluge of parcels at their buildings during Prime Day, as cities increasingly look for ways to ease ecommerce-related congestion.

Big DTCs may have been jumping into Prime Day 2022, but not all direct brands were winners. Based on Google Analytics data aggregated among its 400 ecommerce clients, digital agency Belardi Wong said ecommerce revenue was flat year over year during Prime Day, with AOV growth of just 6% offset by a 7% decline in conversion. Home décor was down single digits, while apparel, shoes and accessories were up single digits.

“These trends are consistent with what we’ve seen in recent months, indicating no impact to DTC brands from Amazon Prime,” said Polly Wong, President of Belardi Wong.

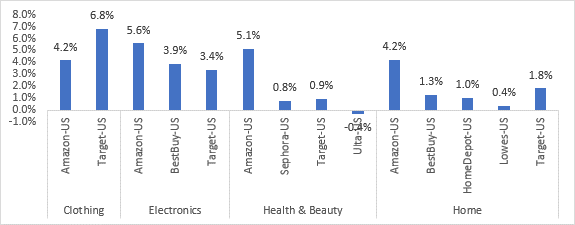

Pricing analytics firm DataWeave found Target competed heavily with Amazon in apparel discounts, but less so in electronics and home, and hardly at all in health and beauty. Amazon’s discounting was tepid across these categories but showed most strongly against other retailers in health and beauty and home.

Comparison of average discounting on Prime Day (DataWeave)