Less-than-truckload platform provide Warp is looking to “gigify” LTL, much as the last mile space has been for the past several years, by letting shippers choose among various types of delivery providers, enabling faster service than waiting for a combined load with traditional carriers.

The service, called gLTL, leverages Warp’s load-matching technology. It taps small, midsize and enterprise carriers using everything from sprinters, cargo vans and box trucks, even SUVs and sedans, and up to full trailers. The B2B offering can accommodate direct-to-store delivery, inventory transfer to fulfillment centers, warehouse-to-warehouse transfers and last-mile delivery.

“If you’re delivering pallet loads, and there’s a lot of delivery area, that’s great for a 53’ trailer or a box truck,” said Warp CEO Daniel Sokolovsky, who co-founded Warp in late 2021 after working at AxleHire. “If there’s less volume or the business has special requirements, maybe it’s a residential area, we can accommodate whatever vehicle is right for the job. It’s convenience and flexibility at an efficient price point.”

gLTL launched in beta in March with one customer in Los Angeles, then expanded to the Inland Empire and Ventura County. Dallas was added in June, then the quad state region of New York, New Jersey, Connecticut and Pennsylvania in August. Plans call for adding 17 more markets by the end of the year, including major hubs like Atlanta, Chicago, Miami and Nashville.

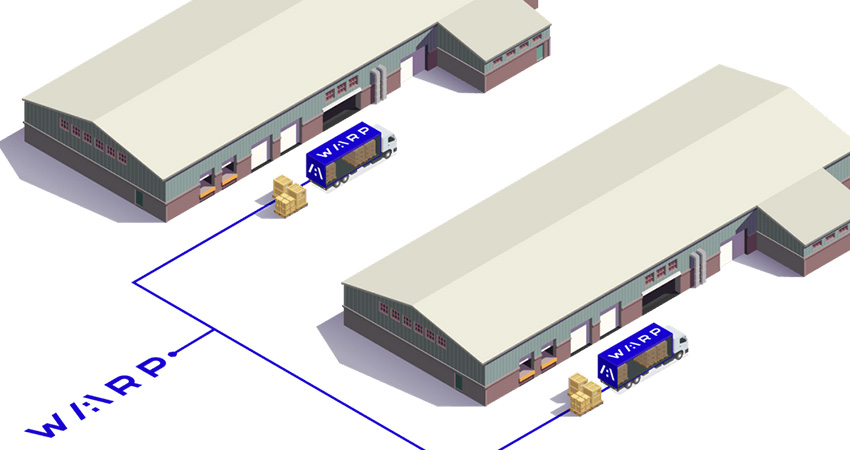

Warp’s technology weaves together digital pooling and physical consolidation points, which it calls Warp Stations, offering shippers middle-mile services at a less expensive price point than traditional carriers. Its system connects to a shipper’s TMS, WMS or carrier management system and a carrier’s driver app, giving shippers pallet-level tracking throughout a shipment’s journey.

Traditional LTL has involved small pickups of a few pallets per stop, along a pre-defined route. Cross docks and warehouses store shipments until the carrier have enough local volume to move the freight to the next destination. Often this means pallets sitting on a loading dock or stored in a warehouse for a few days.

“gLTL allows gig workers to pick up shipments and move them on demand, without waiting for additional local volume,” Sokolovsky said. “Once delivered to a Warp cross dock, freight is merged with other shipments. If there isn’t sufficient volume to fill a traditional 53-foot trailer, smaller vehicles can keep the freight moving and delivered on time.”

Creating gLTL, Sokolovsky said, was a difficult undertaking, considering the complexity of the LTL world. “Think of one LTL transaction,” he said. “There are so many steps, each of which has to be codified into the system to build out the user experience. A driver picks up a load, brings it to a terminal and drops it off. Then there’s a terminal scan, where it’s located in the facility, when it needs to be retrieved, then scheduling, tracking and visibility to the customer.”

Sokolovsky said gLTL also lets smaller players take advantage of load opportunities that would normally go to a traditional LTL carrier, without the major investment in trucks and facilities. Shippers benefit from cost savings of smaller vehicles, faster load execution and using carriers or drivers better able to access tight spots like urban streets.

Prior to launching gLTL, Warp built a network of cross docks serviced by carriers with full-sized tractor-trailers and box trucks. Through this process, Sokolovsky, Warp found many traditional LTL shippers with small, local and frequent freight needs that were not being met under a traditional LTL model.

“So we decided to fix the historical challenges of LTL for smaller, local shippers as well as the medium and enterprise companies we’ve been servicing for the past two years, with more of a regional or national volume profile,” he said.

The gLTL network was built from existing relationships with service providers, and marketing to attract others, Sokolovsky said. It was initially small mom-and pop operations with cross-docking capabilities, then moved up to medium-sized businesses and enterprise players. Food giant Del Monte, for example, is both a Warp customer and partner, making its assets available to the network.

“We can plug into an existing logistics infrastructure pretty seamlessly,” he said. “Some customers are also our vendors, utilizing their existing footprint. If a customer has a warehouse in a particular area and starts working with us, we ask, can we drop off other freight there? If it makes sense, they agree.”