Grocers have been on an ecommerce roller coaster ride the past three years. It began gently following a ramp-up in digital efforts that unfolded while market conditions were stable.

That all changed in early 2020, as e-grocery exploded in dollar and share terms, but there’s been some giveback of those gains in 2022. Still, grocery executives remain bullish on ecommerce, with some expecting it to more than double in their companies over the next three to five years.

When a customer tries e-grocery shopping for the first time, they’re likely starting a critical step in their online grocery journey, underscoring the importance of the omnichannel shift. They’re also likely trying other online platforms in the process. That means retailers must also account for designing digital products and service experiences that promote customer engagement online and minimize cart abandonment. Factors such as customer experience and usability are as critical as service reliability and fulfillment speed.

There’s a steep price to pay for getting those foundational steps wrong: A recent analysis of our shopper data found that churn from e-grocery shopping impacts the bottom line. Nearly 40% of customers abandon an online channel after one purchase. Even if some of them return to brick-and-mortar stores, they spend almost 3% less than before, suggesting they’re also shopping elsewhere.

Getting on the right side of the digital divide

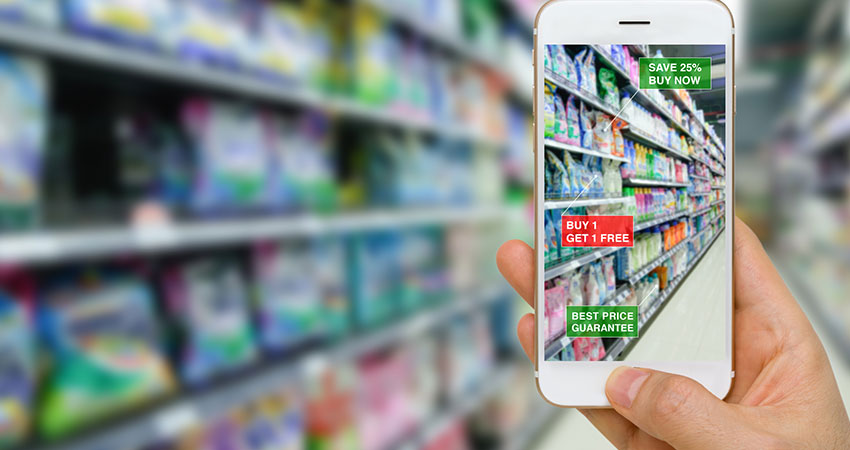

Opportunities related to technology advancements have presented themselves many times over in retail. They all reached a critical point where decisions have to be made about whether to implement the new innovation, and if so, how fast to move forward. Some companies acted swiftly while others failed to take decisive action. Those who recognized the potential of technology and innovation and acted sooner than competitors gained a competitive advantage.

It’s no different today except that technology changes faster than ever, so new sources of potential advantage emerge even more quickly. Further compounding this acceleration is the sheer volume of data available. Simply having that data has not proven to be enough unless the retailer is able to harness its power.

So, how can grocers create an omnichannel strategy and ultimately get on the right side of history? Find new ways to use the data you already have. One way to do this is to adopt a new framework that focuses on pragmatic data analysis:

- Understand what is happening: Identify trends in data to find changes in ecommerce shopper trends in order to quickly correcting course as needed – or capitalize on opportunities.

- Know where to focus: Quickly identify performance drivers for ecommerce channels across customers, geographies, product segments, brands and time periods.

- Identify the why: Understand how operational events like promotions, price changes and out-of-stocks that have impacted results both positively and negatively.

- Shopper contributors: Analyze customer purchasing behavior, breadth of shop, frequency, average price and customer conversion to clearly highlight top contributors to growth and/or decline.

- Proactive opportunities: Look at the data to identify opportunity customer segments ripe for growth, and devise an action plan to capture it. Partner with trusted suppliers to bring new brand experiences to market.

The future is omnichannel

It’s clear that grocery is heading to an omnichannel future. Now that retailers have shown their ability to start delivering on the promise of e-grocery, the next crucial step will be understanding shoppers’ behaviors, preferences and tolerances by looking at the data in a new way. That will be the key for grocers to unlock a true omnichannel experience where consumers can choose the channel that makes the most sense for them.

The more channels that are created, the faster the pace of change. Grocers that leverage data for meaningful customer insights with prescriptive actions are the ones that will win and gain profitable e-grocery share.

Rachael Hadaway is SVP of Product Management, Customer-Centric Retailing, for SymphonyAI Retail CPG