Question: When is Amazon Prime Day not Prime Day, but actually is? When it’s rebranded as Prime Big Deal Days.

The ecommerce giant has once again announced a second major sales event in October, as it did in 2022, when it was called Prime Early Access Sale.

Amazon said only that Prime Big Deal Days will be running in 19 countries: Australia, Austria, Belgium, Brazil, Canada, China, France, Germany, Italy, Japan, Luxembourg, Netherlands, Poland, Portugal, Singapore, Spain, Sweden, the U.S. and the UK.

“We’ll share more details soon as we get closer to the event,” said David Harrington, CEO of Amazon Worldwide Stores in a LinkedIn post. “I can’t wait to give our Prime members access to exclusive early savings this season.”

How will this year’s fall event fare? Prime Early Access Sale did well in 2022 but not when compared to the July event. An estimate from Bank of America put it at $8 billion, 25% lower than the Prime Day haul of $10.7 billion.

While the economy is in a different place than a year ago, with inflation lower, retail sales up and the financial markets stronger, a CNBC poll of retailers found them pessimistic about holiday season spending, and ordering accordingly. But the deal-hunting tendency of most consumers may be a positive indicator for the Amazon event.

According to Adobe Analytics, this year’s Prime Day (July 11-12) brought in an estimated $12.7 billion, up 6.7% from $11.9 billion last year. Amazon itself said July 11 was its single largest sales day ever, with 375 million items sold worldwide.

In the background, various media outlets report that Amazon will meet one-on-one next week with members of the Federal Trade Commission. This is happening ahead of an expected antitrust lawsuit from commission chair Lina Khan, whose view of the issue is a matter of public record from her days at Yale Law School. Baird analysts argued in July against an antitrust breakup of Amazon, saying its success was due more to “novel strategies and innovation” than anticompetitive behavior.

Interestingly, some Prime members used the occasion of Harrington’s post to complain about poor delivery experiences. “I am now afraid to purchase anything from Amazon,” lamented one, while another said, “Buying with Amazon has been the worst commercial experience of my life.”

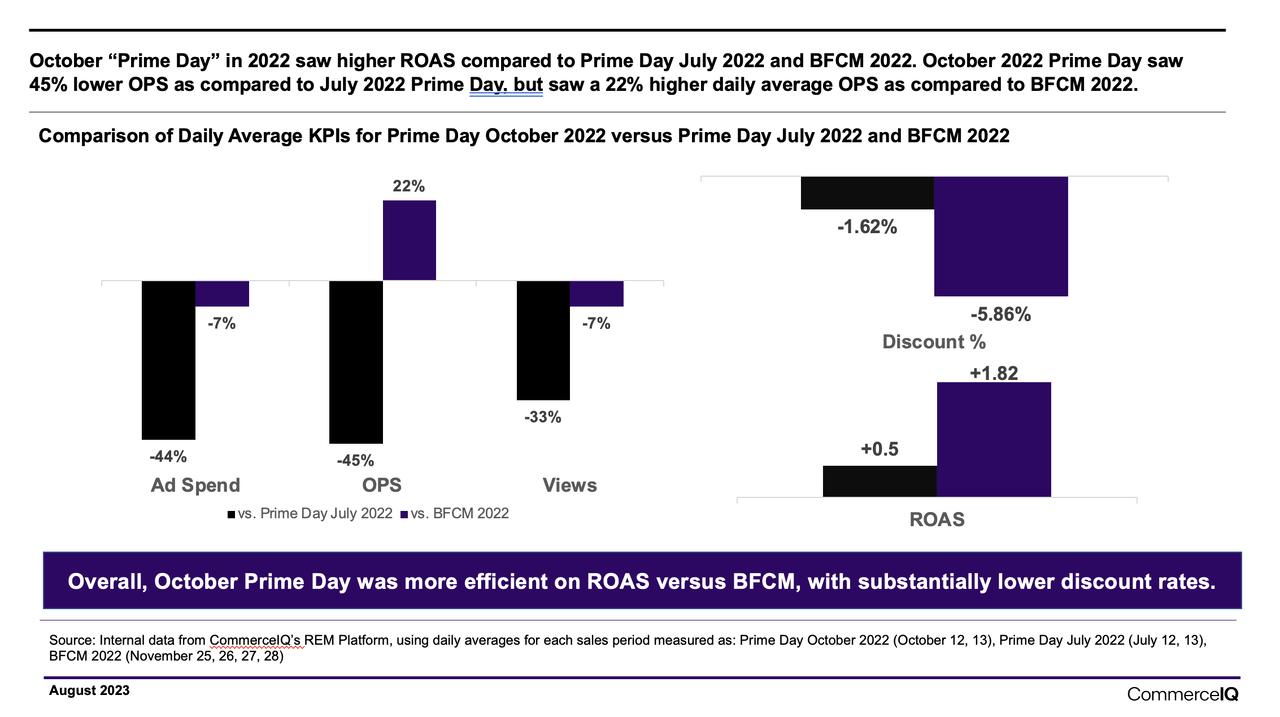

Guru Hariharan, CEO of retail media platform CommerceIQ, said he was curious to see if ad spend performance on Big Deal Days would mirror the 2022 fall event, which had a better return than Black Friday and Cyber Monday, according to the company’s data.

According to Hariharan, brands advertising on last year’s Prime Early Access Sale saw a 22% higher daily average OPS than during Black Friday/Cyber Monday, and did $1.82 better on average in ROAS.

“Simply put, if one had to choose, investing in Prime Day in October yielded much better return on your dollars than BFCM as it relates to your retail ecommerce business on Amazon,” Hariharan said on LinkedIn.