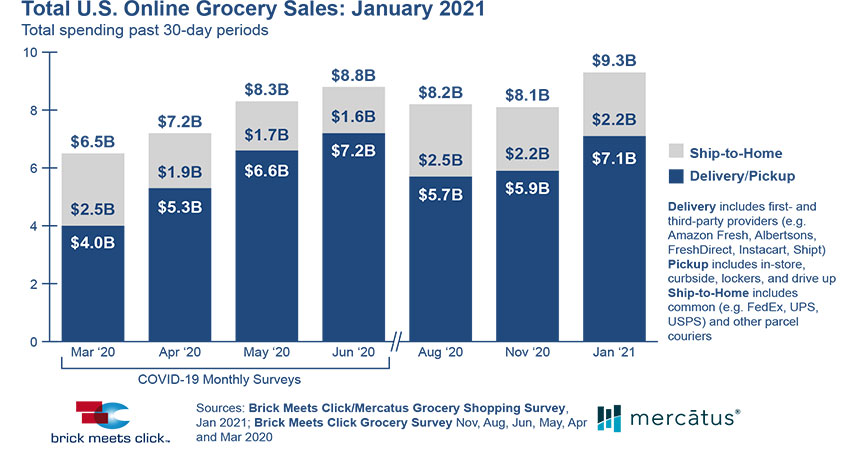

As consumer dollars keep shifting online generally in the pandemic, e-grocery in the U.S. continues to explode, hitting a high of $9.3 billion in January, up 15% from the last time it was tracked in November, according to a survey conducted by Brick Meet Click/Mercatus.

Home delivery by services like Instacart, DoorDash and Shipt, and store/curbside pickup, saw the lion’s share of the spending, representing $7.1 billion or 77% of the total, compared to $2.2 billion or 23% for ship to home by traditional services like FedEx and UPS. Over three-fourths of monthly active users – 78% – took advantage of home delivery or pickup in January, up from 64% in November.

Overall, Americans spent $791.7 billion on ecommerce in 2020, up 32.4% from 2019, according to new data from the Commerce Department’s Census Bureau, with e-grocery one of the leading categories.

In January, more than 69.7 million U.S. households placed an average of 2.8 e-grocery orders, according to the survey, about the same as November. The peak was 76.7 million households in April 2020, shortly after the COVID-19 lockdowns began.

Between November and January, there was a 16% increase in the number of households buying groceries online.

In terms of share of total orders, delivery and pickup gained about six percentage points to 66% of the total for January. Average order value across all order types was down nearly 11% in January compared to November 2020.

With all the growth, there is still a level of dissatisfaction among shoppers, the survey found. Among the most experienced e-grocery buyers, those signaling intent for repeat purchases dropped 18 percentage points between November and January. Grocers continue to struggle with the logistics and costs of e-grocery fulfillment, attempting to balance labor with major capital outlays like automation as well as per-order fees from delivery services.

“Even though many grocers remain capacity constrained – especially with pickup – others are growing market share as they staff up or expand pickup to a larger store base,” said David Bishop, a partner with Brick Meets Click, in a release. “While throwing more labor at the issue isn’t ideal, this, along with improving assembling productivities via enhanced pick and pack practices, is vital to remaining competitive in the near term and not inadvertently giving your customer a reason to shop elsewhere.”

Brick Meets Click surveyed 1,776 adults between Jan. 28-31. The results were adjusted based on internet usage among U.S. adults to account for the non-response bias.