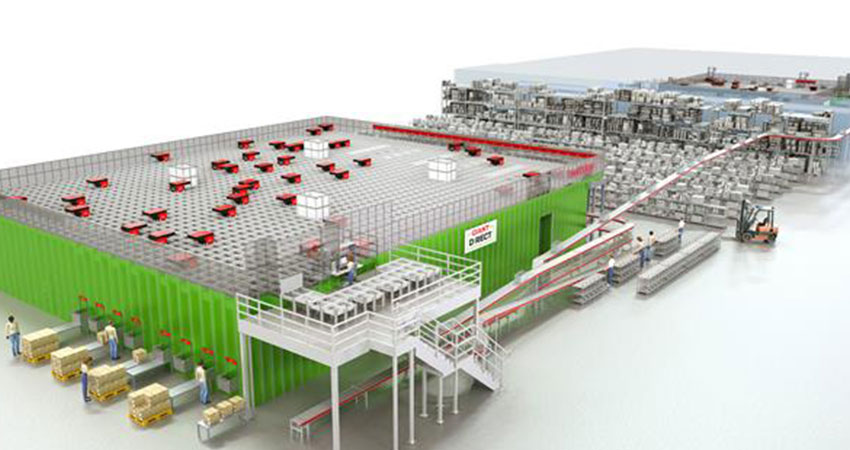

A rendering of the Philadelphia e-grocery FC by AutoStore and Swisslog (Ahold Delhaize)

Ahold Delhaize, the Netherlands-based grocery conglomerate that owns Stop & Shop, Giant and other U.S. chains, plans to pilot micro-fulfillment technology at one of Giant’s fulfillment centers in Philadelphia as it competes with Kroger’s e-fulfillment model using tech partner Ocado.

The project leverages a grid-based AS/RS hive system from AutoStore, as well as syncing software from system integrator Swisslog, and manual picking from Peapod Digital Labs. While calling it micro fulfillment, a video simulation of the new fulfillment center looks more along the scale of a massive Kroger/Ocado facility than smaller store-based MFCs from providers like Fabric, Takeoff Technologies and Dematic.

Ahold is looking to expand its e-grocery capabilities with the pilot, as well as its omnichannel supply chain as it battles Walmart, Kroger, Albertsons and Publixx atop the grocery leaderboard.

“Over the past year, all Ahold Delhaize USA companies have seen a tremendous increase in online sales growth, and we believe this growth is here to stay,” said JJ Fleeman, president and chief ecommerce officer of Peapod Digital Labs, in a release. “As we think about shifting consumer expectations and the future of omnichannel shopping, we must continue to build and evolve our already strong infrastructure to optimize pick-up and delivery.”

By March 1, Ahold’s U.S. network will include 18 traditional distribution centers, 28 ecommerce fulfillment centers and 1,100 click-and-collect locations. By 2023, it will have 27 DCs while adding FCs and expanding click and collect.

“As we continue to transform the supply chain for the future, we’re doing so with the lens of creating a truly omnichannel supply chain, there for customers whenever, wherever, however they want to shop,” said Chris Lewis, EVP, Supply Chain for Retail Business Services, Ahold Delhaize USA.

According to new research from Nielsen and The Food Industry Association (FMI), Americans spent $106 billion online on food and beverage in 2020, a 125% increase from the prior year. The research also found that a year into the pandemic, monthly e-grocery sales continue to pace $3 billion ahead of 2019.

The embrace of e-grocery by baby boomers was one of the more surprising trends in 2020. According to NPD Group’s Checkout, consumers 65 and older spent on average $1,615 online at grocers from January through October, up 49%, making it the fastest-growing demographic.