Against a backdrop of supply chain disruption, the ecommerce boom and worldwide driver shortages over the last several years, many brands have faced hurdles concerning fulfillment while logging more home deliver failures. Although some have tailored their strategies to overcome them, others haven’t been quite as successful.

While addressing these issues directly can often be tedious and overwhelming, any retailer who accepts mediocre service today will risk negative impact to their top- and bottom-line performance as consumers turn to other brands leveling-up their home delivery game.

Recent findings from a new report, Ecommerce: Is Retailer Fulfillment and Delivery Performance Keeping Up with Sales Growth?, support this trend. Surveying 8,000+ consumers across North America and Europe in January 2022, Descartes and SAPIO Research sought to understand perceptions of online buying and home delivery. What they found was that while consumers are certainly committed to ecommerce, they’re currently unhappy with inconsistent delivery performance, and a significant number are ready to punish poor performing retailers as a result.

So, what should retailers know when it comes to ecommerce purchasing behaviors and delivery today, and how can they address these issues to avoid home delivery failures tomorrow?

Consumers Will Keep Buying Online

Unsurprisingly, the data showed that consumers bought more online during the pandemic (46% of all purchases vs. 35% pre-pandemic). However, respondents also indicated they will continue to increase their online buying to almost half (48%) of total purchases.

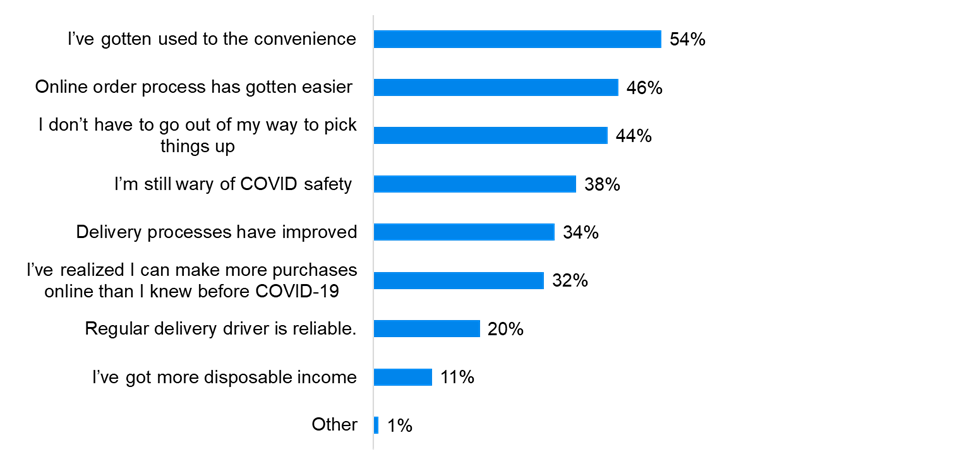

While it’s unknown whether this percentage will decline as the impact of COVID-19 subsides and consumers frequent stores more often, ecommerce is more intuitive and convenient than ever before. This has helped to minimize consumer hesitation to buy certain goods online, and spurred participation among older consumers (see Figure 1). When asked why they’ve increased online purchasing, respondents cited convenience (54%), ease of ordering (46%) and not having to pick up their order (44%). Even more compelling: 64% of those 55 and older said they were now used to the convenience.

Figure 1. Top Reasons for Increased Online Purchase and Home Delivery

Source: Descartes and SAPIO Research

Delivery Failures = Unhappy Customers

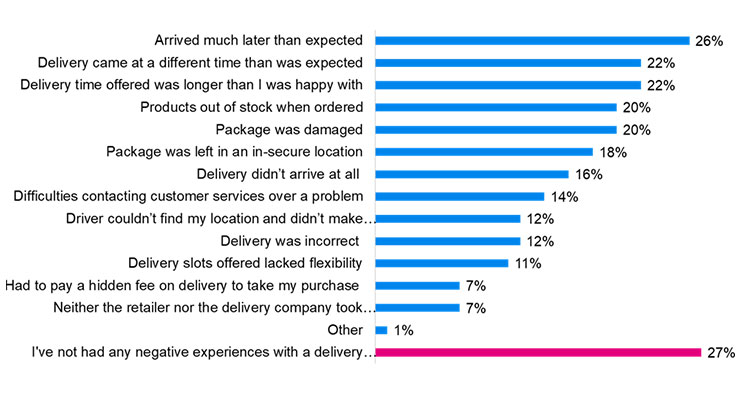

While the increase in ecommerce buying and delivery is good news for merchants, the bad news is that only 34% of consumers said delivery processes have improved (see Figure 1). Worse still, almost three-quarters (73%) of consumers experienced a delivery failure (see Figure 2), with almost one-quarter (23%) indicating they did not order from that retailer again. Top issues cited were late delivery (26%), followed by “delivery not arriving when expected” and “length of time to make delivery (tied at 22%).

Retailers clearly need to assess their delivery performance and the expectations they set for customers in terms of delivery speed, reliability, and precision. The belief that delivery speed is the most important factor to consumers is simply not true. Consumers place more value on retailers making a delivery promise and keeping it.

Figure 2: Consumer Delivery Experience in Last 3 Months of 2021

Source: Descartes and SAPIO Research

Source: Descartes and SAPIO Research

Consumer Fatigue, Frustration Blows Back on Retailers

“The last mile is the last word”—and what consumers remember. Among those who experienced delivery failures, 24% said it meant lost trust in the delivery company. This was followed by refusing to order from the retailer again (23%) and lost trust in the retailer (21%). Additionally, 17% indicated they advised friends/family to avoid that retailer.

While a lower number, the loss of future business and reputational damage can certainly exceed the actions of individual consumers. Factor in social media and the potential for individuals to negatively — and quickly — influence many more people makes the consequences of delivery failures even more damaging.

Since the cost of customer acquisition online is so high, a premium should be placed on consistent delivery performance to help keep customers for life.

Environmental Concerns Create Delivery Opportunities

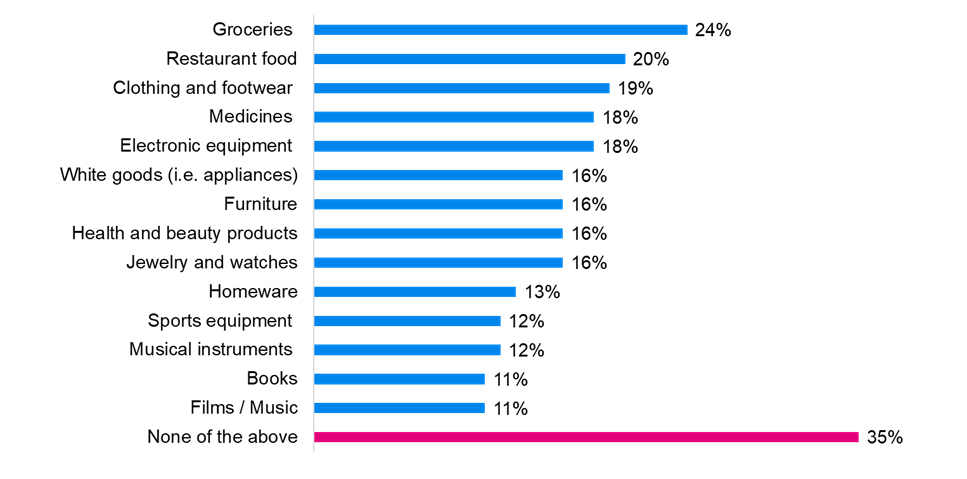

The study showed that 65% of consumers think twice about ordering online due to the environmental impact (see Figure 3). Those 18-24 years (85%) and 25-35 years of age (75%) are the most concerned for the environment. The types of deliveries associated with the greatest environmental concern were grocery (24%) and restaurant food (20%).

The message for retailers is clear: Consumers will favor retailers who are more environmentally friendly. This is especially true for retailers targeting younger generations.

Figure 3: Consumer Environmental Home Delivery Concern

Source: Descartes and SAPIO Research

Leading retailers understand that consumers have unique delivery personas that can help the environment and bottom line. The key is to provide consumers with delivery options and understand that a relatively small percentage of consumers can make a significant difference.

For example, one-third of consumers are quite/very interested (34%) in combining orders into a single delivery at the end of week, or in combining orders for a single delivery when there are multiple deliveries in their area (33%). These delivery options not only translate to smaller carbon footprints but also significantly lower delivery costs.

Equally, the survey showed that consumers are quite/very interested in paying more for a faster (22%) or a more convenient delivery time (21%), again providing retailers with incremental revenue opportunities.

Importance of Delivery Performance Sent Loud and Clear

This consumer sentiment underscores that retailers and their delivery partners need to improve performance or risk losing customers to competitors who do. Instead of viewing this insight as another challenge for their businesses, industry leaders should leverage it to capture market share and more ecommerce business as consumers increasingly turn to online shopping.

Retailers have an even greater opportunity to find favor with consumers and improve financial performance if they can capitalize on heightened environmental concerns with delivery options that simultaneously result in a smaller carbon footprint and lower delivery costs.

Chris Jones is EVP, Industry and Services at Descartes