Postal consolidation and global logistics firm Pitney Bowes is expanding its 1-3-day delivery services to more than 20 U.S. cities in the Southeast as well as in Texas, Lousiana and New Mexico, in a push to makes its services more attractive to shippers in a down market and reverse its losses.

Cities added in the south include Birmingham and Huntsville, AL, Miami, Orlando and Tampa, FL, Atlanta and Savannah, GA, Jackson, MS, Charlotte and Raleigh, NC, Greenville, SC and Nashville. Pitney Bowes said it can provide 1-3-day service to the region for shipments originating in Atlanta and Orlando.

Other cities in the mid-south and Southwest include Little Rock, AR, Baton Rouge and New Orleans, LA; Albuquerque, NM, Oklahoma City and Tulsa, OK, Austin, Dallas-Fort Worth, El Paso, Houston and San Antonio, TX. Shipments from Dallas to this region get 1-3-day service.

Pitney Bowes says the expansion will help shippers reach an additional 100 million consumers with 1-3-day service, in select ZIP codes within the two areas.

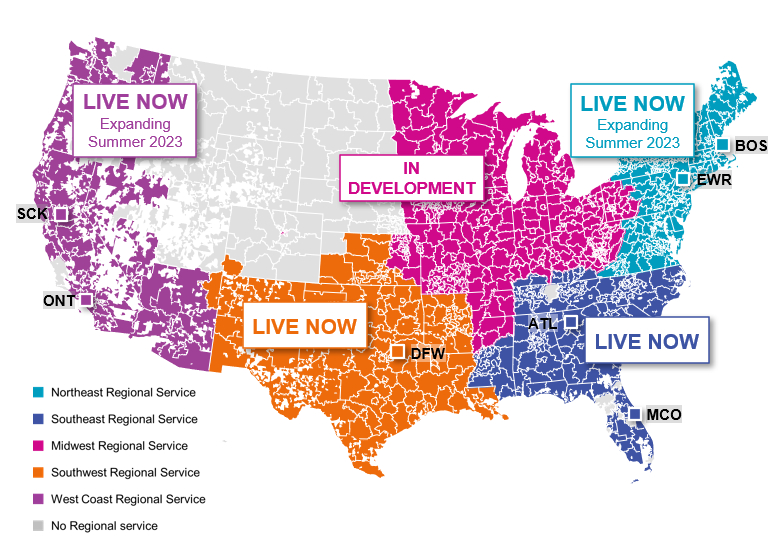

The company will have fresh competition in the Lone Star State. Regional carrier OnTrac said last month it has expanded its coverage to Dallas-Fort Worth, Austin, Houston, and San Antonio, with a reach of 19 million consumers. OnTrac says it now has coverage of 80% of the U.S. population across 31 states and Washington, D.C. The company said the move was on its roadmap when it announced transcontinental coverage in August 2022.

Pitney Bowes launched regional 1-3-day service last year in northern and southern California for parcels originating from Los Angeles and San Francisco, and the Northeast region for origins near New York and Boston.

Gregg Zegras, EVP and President of Global Ecommerce at Pitney Bowes, said regional services helped the company grow its ecommerce volume by 22% in the first quarter, from 41 million to 50 million parcels.

Pitney Bowes uses shipping volume data analysis to help retailers and brands determine which parcels should be sent via a regional model vs. national, in order to maintain national volume tier discounts, under its Designed Delivery program.

For the second quarter ended June 30, Pitney Bowes reported $776 million in revenue, down 11% from 2022 and down from $835 million in Q1. The net loss was $141.5 million, compared to a loss of $8 million in Q1 and net income of $4.3 million in the year-ago quarter. Presort services was again the only unit to show a revenue gain (up 3% to $143 million) and profit, while global ecommerce revenue was down 21% to $313 million, and Send Tech revenue (SMB services) dipped 4% to $321 million.

In May, four of five directors proposed by activist shareholder Hestia Capital Management were added to the Pitney Bowes board at the annual meeting, after a contentious proxy fight.