Ecommerce sales on Black Friday dipped slightly this year, to $8.9 billion from $9 billion in 2020, reversing years of growth, according to data from Adobe Analytics, with larger retailers seeing 22% higher growth than small businesses while the latter saw higher average order value.

Adobe Digital defines “small” retailers as those with $10 million to $50 million in annual sales, while larger retailers are those with $1 billion or more in annual sales.

“Shoppers are being strategic in their gift shopping, buying much earlier in the season and being flexible about when they shop to make sure they get the best deals,” said Vivek Pandya, a lead analyst with Adobe Digital Insights, commenting on the Black Friday results.

Categories with the strongest ecommerce growth over September levels included toys (up 954%), books (up 671%), video games (up 648%), appliances (up 617%), personal care (up 553%) and apparel (up 376%), according to Adobe Digital.

Not surprisingly, out of stocks continue to be a major theme this holiday season. As of Friday, out-of-stock messages were up 124% during November vs. January 2020, Adobe Digital reported, before the pandemic lockdowns. Categories seeing the most messages were appliances, electronics, housekeeping supplies and home and garden.

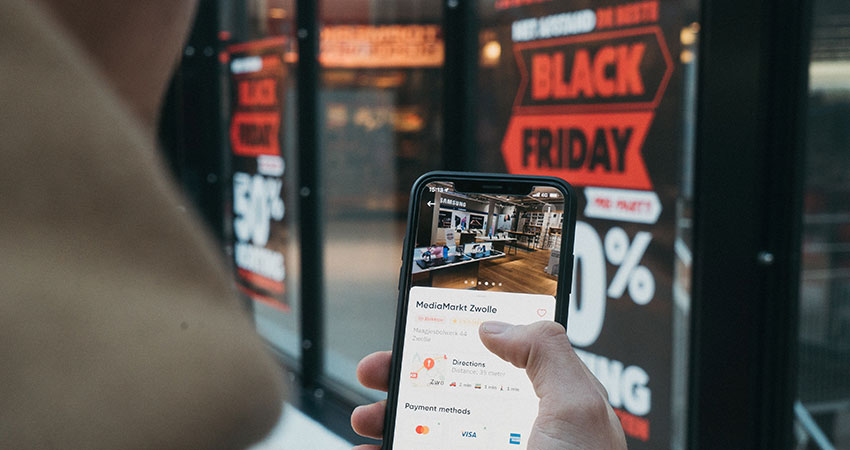

Meanwhile, U.S. store and mall traffic on Thanksgiving and Black Friday, while up 47.5% from 2020 – when stores had reduced hours and pandemic fear was heightened – was down 28.3% from the baseline of 2019, according to data from Sensormatic Solutions. As of 3 p.m. EST on Friday, retail sales overall were up 29.8% compared to 2020, but up 42.9% in stores, according to MasterCard SpendingPulse.

Separately, ChannelAdvisor tracked ecommerce sales during what it calls “Thanksgiving week” (Sunday through Saturday). For that period, top growth categories on its platform across major marketplaces included baby gear (+36% in gross merchandise value), mobile and accessories (+26%), apparel (+26%), pet supplies (+15%) and computers and networking (+11%).

“Of course, this represents only one week of data and may say more about the timing of promotional activity and the impact of supply chain fears than overall category performance,” ChannelAdvisor noted in a blog post.

Despite all the warnings about supply chain backlogs, the majority of Americans are still delaying their holiday purchases, with Black Friday and Cyber Monday shopping skewing young, according to data from Cordial, a communications platform for retail and DTC brands. Cordial found that 45% of Gen Z shoppers, 36% of Millennial shoppers and 22% of Gen X shoppers were flocking to online deals on both days, while just 10% of baby boomers were doing so.

In a separate survey, Oracle Retail found slightly more than half of U.S. consumers planned to shop earlier than usual this year, based on concerns over late deliveries.

Two trends have remained strong through the official kickoff of the holiday shopping season, according to Adobe Digital. Online orders fulfilled using curbside pickup is up 70% in November through Black Friday compared to November 2019, and was part of 20% of all Black Friday online orders, slightly below previous days. And buy now pay later (BNPL) is up 422% vs. November 2019, and the volume of orders is up 438%.

Even with the slight dip on Black Friday, the holiday season has been strong online thus far, according to Adobe. Spending has surpassed $2 billion every day this month through Nov. 26, with 19 days over $3 billion. During the same period in 2020, there were five days over $3 billion and 22 days north of $2 billion.

Adobe Digital Insights’ analysis is based on more than one trillion visits to U.S. retail sites, 100 million SKUs and 18 product categories.