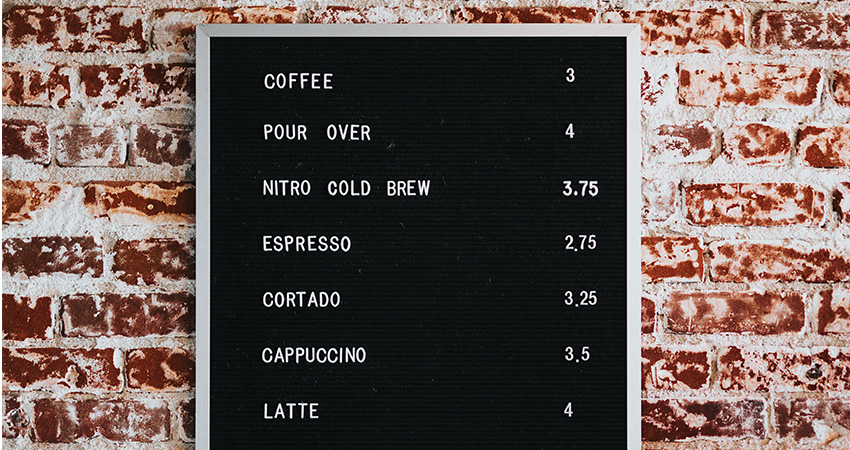

Online prices continue to decline, but overall inflation has soared since November 2020 (credit: Nathan Dumlao on Unsplash)

Online prices continue to fall as inflationary pressure has eased and retailers discount to clear out stocks ahead of Q4 ordering. Prices were down 2.3% year-over-year in May, the largest drop since the onset of the pandemic, and down 1.2% from April 2023, according to Adobe Analytics.

Overall, the report was good news for consumers, with online prices declining last month in 11 of the 18 categories tracked by Adobe, but bad news for retail ledgers as costs have not retreated in tandem. May represented the ninth straight month of an overall slowing of growth in online prices.

Larger-ticket discretionary categories remain challenged, with Adobe’s figures echoing earnings call after earnings call from big-box chains like Best Buy, Target and Walmart. Online prices for computers were down 16.5% year over year and 2.4% from April to May, with prices for electronics (-12% and -1.8%) and appliances (-7.9% and -2.4%) also seeing sizable declines.

Adobe reported May was the eighth straight month that price increases slowed in grocery, since record highs in September when they spiked 14.3%, sending consumers reeling. Grocery prices in May were up 8.3% from a year ago but just a 0.3% tick from April.

This last figure lines up with the latest data from the Bureau of Labor Statistics, which showed a mere 0.1% increase in the Consumer Price Index for May, compared to a 0.4% rise the prior month. Year over year, the CPI was up 4%. Thus, overall inflation is at a virtual standstill after a steady ride up for the past couple years.

A monthly report on e-grocery from Brick Meets Click and Mercatus showed online spending in the category continuing to tumble, challenging the bumper crop of providers that saw huge pandemic gains. The $6.9 billion in total sales for May was down 3.4% from $7.2 billion a year ago, with fewer households clicking “buy” while the average number of orders from active shoppers fell 5% to 2.51, the companies reported.

“The decline in order frequency is the result of the growing number of monthly active users who placed only one e-grocery order during the month,” said David Bishop, a partner with Brick Meets Click in a release. “This accounted for one-third of all active customers and caused headwinds across all the segments.”

Online prices for personal care items, another staple category, have fallen along with grocery, Adobe reported, with smaller increases each of the past three months. They rose 2.7% year over year in May, 3% in April and 4.4% in March. From April to May, personal care prices online actually declined 0.3%.