Shopify is acquiring asset-light last-mile startup Deliverr for $2.1 billion in cash and stock, further building out its fulfillment infrastructure and giving it a counter-move to Amazon’s recently announced Buy With Prime program that extends the Prime experience to other retailers.

But the question is, will it be enough to enable Shopify to gain ground on its much larger competitor, whose Buy With Prime, many observers believe, was clearly aimed at crimping Shopify’s growth? Shopify has an estimated 1.75 million third-party merchants on its platform, vs. 9.7 million for Amazon.

The Deliverr news was announced along with Shopify’s Q1 earnings, which like Amazon last week missed projections on both the top and bottom line. Revenue increased 22% to $1.2 million, but the analyst consensus was $1.24 billion, and earnings per share was 20 cents vs. an expected 63 cents. That plus the size of the acquisition sent shares down 15%.

Deliverr, founded in 2017, fulfills more than 1 million orders per month on behalf of thousands of U.S. merchants. Its latest $250 million funding round increased its valuation to $2 billion.

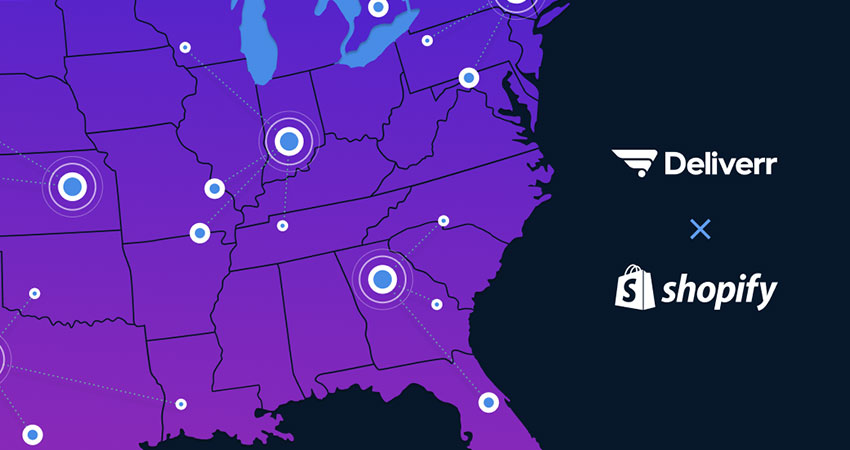

Through partnerships with warehouse owners across the country, Deliverr uses shippers’ own data and its algorithm to optimize inventory placement. It leverages unused space in high-demand areas for fast delivery, tapping its partners’ own fulfillment capabilities. Deliverr integrates with major ecommerce platforms including Walmart.com, eBay and Amazon in addition to Shopify.

Shopify said Deliverr will help it speed up development of its Shopify Fulfillment Network, founded in 2019, as an end-to-end logistics platform managing inventory from “port to porch” and across all sales channels, including for merchants not selling on Shopify.

“Our goal is to not only level the playing field for independent businesses, but tilt it in their favor — turning their size and agility into their superpower,” said Shopify CEO Toby Lütke in a blog post. “Together with Deliverr, SFN will give millions of growing businesses access to a simple, powerful logistics platform that will allow them to make their customers happy over and over again.”

“Our technology and expertise in inventory management, inventory placement, and demand chain combines perfectly with Shopify’s roadmap, enabling us to now build an end-to-end logistics platform together,” said Harish Abbott, co-founder and CEO of Deliverr in the post. “Shopify has been building the future of merchant-first fulfillment solutions, and our team has a track record of helping businesses of all sizes streamline their operations.”

SFN, robotics unit 6 River Systems – acquired by Shopify in 2019 for $450 million – and Deliverr will be joined together in a new logistics unit under newly appointed CEO Aaron Brown, who has led SFN since 2020. Shopify is also rolling out something called Shop Promise, offering two-day and next-day delivery as well as options for returns, storage, freight and inventory prep.

“Shop Promise guarantees merchants what no other commerce platform can: full ownership of their brand, business intelligence, and customer data,” Shopify said in the blog post, a clear shot at a major knock on dealing with Amazon.

While a significant boost for Shopify’s overall offering and logistics network, the addition of Deliverr may not impact the unit economics of using SFN vs. Amazon’s more extensive FBA program. Third-party ecommerce sellers see Amazon as a cheaper and more robust alternative for getting orders out quickly and inexpensively to end customers.

“Over the years, sellers, myself included, have used bundles and other bulk purchase incentives for Shopify orders,” Martin Smith, co-founder of Ecommerce Aggregators, told UK publication Charged Retail. “These drive down the unit cost of 3PL to directly improve DTC margins. Yet no matter how creative you are with seller-fulfilled orders, 3PL simply cannot complete with Amazon FBA – both financially and logistically.”